Can blockchain technology change the way donations are managed in a natural disaster? With an ingenious approach, backed by the power of a technology that’s taken the world by storm, Telcoin is on a mission to get disaster relief aid directly to the victims who need it most – no middleman agency required.

But first, I want you to imagine two scenarios. Both of these – as shocking as they are – are not only theoretically possible but they’re happening and will continue to happen. So join me and take a trip down Imagination Lane.

Scenario 1: The Worst that Can Happen

You’re out shopping, perhaps with your kids, maybe with a friend. Suddenly, the mall turns into a frenzy of voices expressing utter shock as people stop in their tracks, glued to the screens of the television sets in the windows of the shops they were busy passing. Mobile phones ring all over the place, faces ashen, and people stare into the void as the individuals on the other side of their phones break the news.

You’re still busy trying to figure out what exactly is going on when your mobile rings. Suddenly, the bizarre behavior of those around you makes sense. A coastal city a few hundred miles away from you has just been struck by a cataclysmic tsunami, followed minutes later by a colossal earthquake. You have family in that city, as do many of the people around you.

Everyone’s primary concern is the safety of their loved ones. The second thought that follows almost immediately thereafter is, “How do I help? What can I do?”

Money Down the Drain

Humanitarian agencies exist to serve people in need. That’s their mission. It’s why donations flow in in the aftermath of natural disasters as donors trust that their contributions will aid those in dire need of it.

Yet, in practice, said money often falls down a pit, bogged down by costly administrative fees, bureaucratic monetary transfers and processing procedures.

In the aftermath of the 2010 earthquake in Haiti, the American Red Cross reserved nearly US$44 million of donated funds for administrative fees. Two years later, however, a total of nearly US$340 million, or 70 percent, had not been used to provide relief to victims of this disaster.

If you bear witness to a catastrophe and are moved to part with any amount of your hard-earned cash (or via government aid thanks to the taxes you pay), you give because you want the money to reach and directly help disaster victims whose lives are uprooted or even destroyed in the wake of the event.

Unfortunately, there’s just no way of knowing in whose hands your donation will end up.

Scenario 2: Disaster Era, On!

Now imagine that the scene that plays out above keeps repeating with increased frequency. Today, it’s your in-laws who are affected; three weeks later, it’s your best friend from childhood.

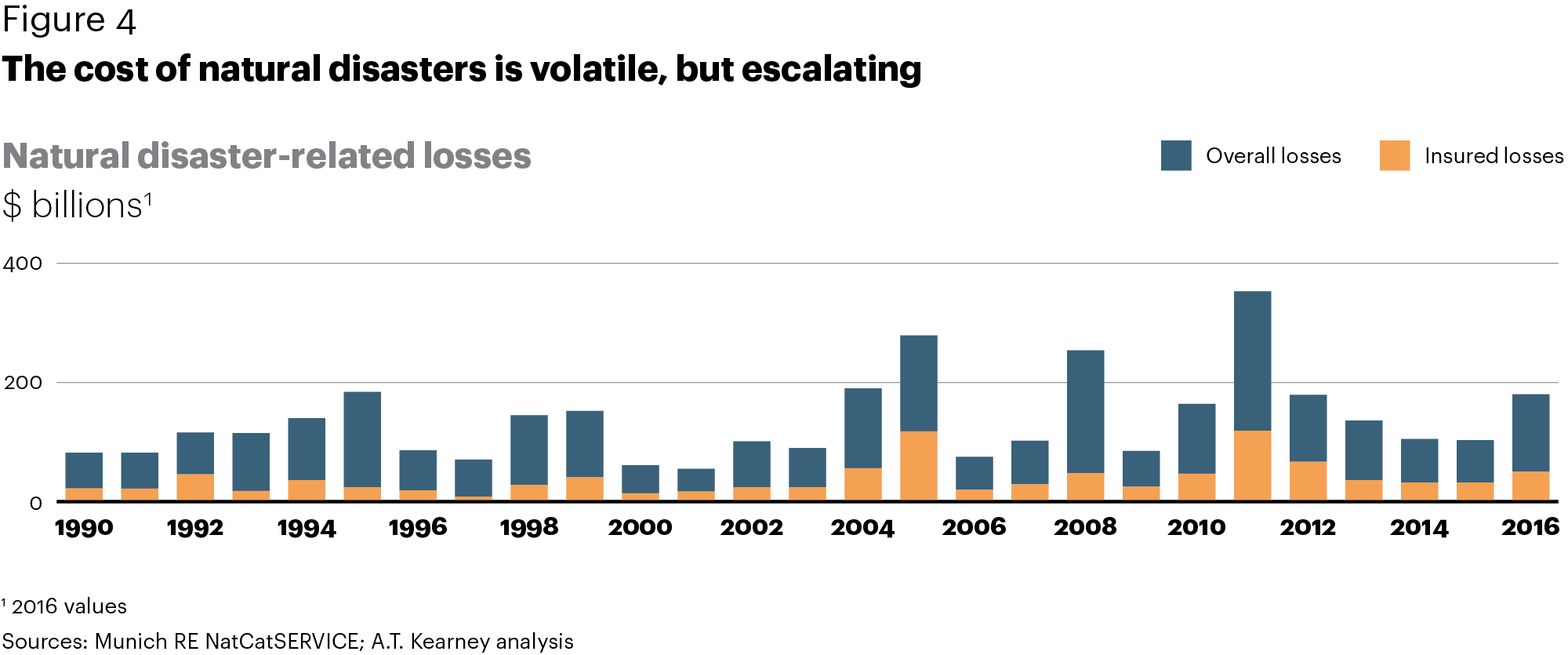

The National Oceanic Atmospheric Association reports that between the years 1980 and 2016, the US experienced an average of 5 natural disasters annually, each costing more than US$1 billion in damages. Between 2012 and 2016, however, this annual rate has doubled to 10 natural disasters, burdening the economy with bills worth at least US$10 billion every year.

Natural disasters are costly. They take lives without asking, traumatize those left behind, and flatten infrastructure and property in their wake. And thanks to the effects of climate change, they’re set to increase in frequency.

The Climate Science Special Report issued by a team of US governmental agencies looks at the rise of the various natural disasters that will plague the earth in years to come. On the topic of cyclones, the report states:

Both physics and numerical modeling simulations indicate an increase in tropical cyclone intensity in a warmer world, and the models generally show an increase in the number of very intense tropical cyclones. For Atlantic and eastern North Pacific hurricanes and western North Pacific typhoons, increases are projected in precipitation rates and intensity. The frequency of the most intense of these storms is projected to increase in the Atlantic and western North Pacific and in the eastern North Pacific.

Houston, We Have a Problem

In 2017, Hurricane Harvey wrecked havoc across parts of Texas. Aid was streaming in but, in keeping with the red tape that so often bogs down crucial processes in emergency states, moving money to aid victims proved no mean feat. One organization, however, came prepared.

The International Church of Blerk (ICOB) is a crypto-based registered charity and religion: blockchain is their god. During Harvey, they were able to move funds when others couldn’t due to their ability to use cryptocurrency.

Staff member Dr Rhiana Ireland, an Emergency doctor, said of ICOB’s experience during the disaster:

Bitcoin has helped the relief efforts by allowing us to rapidly scale up as the disaster presented itself. We lost equipment during the hurricane and were not nimble enough to allow us to buy things late at night and during the weekend. Banking hours are fixed but a hurricane doesn’t care about that. Bitcoin is a 24-hour currency for a 24-hour disaster.

How Cryptocurrency Can Save the Day

Nonprofits are increasingly accepting donations in the form of cryptocurrency and there are even crypto-dedicated charities like BitHope utilizing this new currency format.

Digital currencies have the potential, as IOBC illustrates, to provide relief to immediate pressing matters. The United Nation’s World Food Programme issued ethereum vouchers to 10,000 Syrian refugees in Jordan, with a plan to extend the trial to 100,000 individuals. BitNation, on the other hand, is using blockchain technology to issue emergency IDs and visas.

But how do we move from situation and area-specific solutions to a one-size-fits-all approach that can be deployed anywhere, anytime, at a moment’s notice?

Telcoin believes it has the answer.

Using the Blockchain to Work Smart

As a company, Telcoin has a unique proposition unheard of in the crypto market. Teaming up with mobile network operators, they are able to distribute cryptocurrency via mobile money channels. By leveraging existing customer bases in emerging markets, the company is able to provide millions of unbanked and underbanked access to affordable financial systems that are not dependent on banking systems or subject to international remittance hurdles.

Their unique selling proposition is a feature that shows great promise and makes the company a natural market leader catering to those who most need cryptocurrency to solve real-world problems. But it’s their capacity to provide instant, transparent relief to disaster areas around the globe that makes Telcoin one of the most promising blockchain companies to get behind.

Providing Aid Directly to Those Who Need It

Mobile tower infrastructure generally withstands natural disasters – and if towers are down, it’s a top priority to get them operational again, as communication channels during a crisis are always one of the first systems to be reinstated. At their base stations, towers usually have a surplus of batteries and backup generators. Remote stations can also be connected via microwave or satellite.

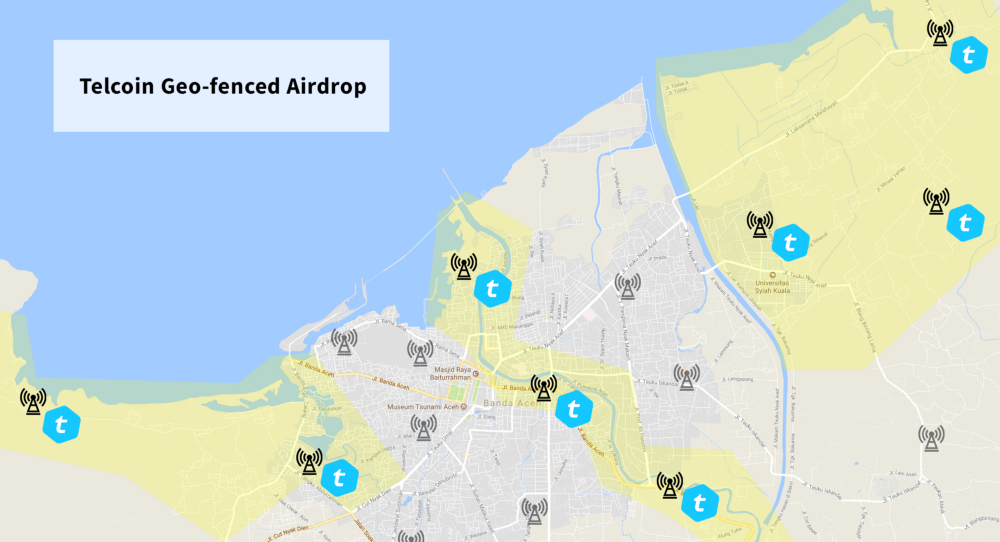

In case of a natural disaster, Telcoin is able to geo-fence a given area and airdrop (equally distribute) via mobile money wallets. In this way, cryptocurrency tokens are deposited into the mobile phones of everyone whose networks show them as active within those coordinates before or during a natural disaster.

Thanks to blockchain’s inherent transparency, donors are able to track directly where their money goes. And Telcoin has pledged to waive all fees attached to transactions in such an event.

Recipients of Telcoin tokens can use the text and USSD functionality in their phones (no smartphone required) to transfer funds to the mobile accounts of goods providers in the affected area. This way, essentials can reach those who need it much faster, with greater ease, and at a lesser cost than the time-consuming, laborious, and costly international transfer process.

To summarise: thanks to Telcoin, aid that is meant for the victims of a disaster will be distributed equally to all members affected by the catastrophe, free of charge.

Telcoin is proof that thanks to blockchain technology and human ingenuity, some of our most pressing problems can be mitigated easily and – most importantly – without astronomical costs attached to it.

Telcoin’s ICO

Telcoin’s mission is to become “one of the cornerstone financial inclusion efforts of the 21st century”. This startup will surely play an enormous role in cryptocurrency adoption in emerging markets and in providing direct financial aid during a crisis.

To get involved, take part in their ICO which runs from 11 December 2017 to 11 February 2018 (or when their US$25 million hard cap is reached). You can purchase Telcoin tokens using ethereum (ETH), bitcoin (BTC), or fiat.

For more information, visit https://www.telco.in/ico/. You can also follow them on Twitter, and join their Telegram group.