Telcoin is a blockchain company with a difference. They’ve set their targets on using cryptocurrency to serve the world’s neediest, and thanks to their unique business model, they’re on a fast track to do just that. We look at what they do, and why the world needs it.

Economic Travesty

You might have debt and still far-off from that Lambo you’re eyeing for when bitcoin lands on Jupiter. But here’s some perspective: if you’re earning US$32,400 per annum, you would be considered to be in the world’s top 1 percent by income level.

Wealth distribution is grossly unequal. Half of the world’s wealth is owned by 8 people, with their collective fortunes equal to the income of the bottom half (3.6 billion) of the world population. What’s more, 1 in 10 people make do with less than $2 per day.

According to Mark Goldring, chief executive of Oxfam GB:

This year’s snapshot of inequality is clearer, more accurate and more shocking than ever before. It is beyond grotesque that a group of men who could easily fit in a single golf buggy own more than the poorest half of humanity.

While one in nine people on the planet will go to bed hungry tonight, a small handful of billionaires have so much wealth they would need several lifetimes to spend it. The fact that a super-rich elite are able to prosper at the expense of the rest of us at home and overseas shows how warped our economy has become.

Our existing economic structures is what created this sorry state of affairs. Without alternatives, we’re on a trajectory to doom with the rich getting richer and the poor poorer, and the middle class caught in between, themselves experiencing increased financial hardships.

Blockchain as an Answer

The system is broken, that much is clear. And as a species, we’re very slow to react to broken systems. Technology continues to prod and probe us out of our miserable but familiar comfort zones.

While we can talk at length about the dark side of technology, it’s clear that much of the global liberation and emancipation that various groups have been experiencing in the past 20-odd years have been due to the existence of the internet and subsequent technologies.

Blockchain is a technology that’s as mysterious to all of us as it seems complicated to newbies and the uninitiated. No one knows who Satoshi Nakamoto is, or whether he’s even a real person and not a group with their own particular motives. But the fact remains that the rise of blockchain has created for humanity a fork in the road that is changing the very broken systems we never had alternatives for in the past.

Invest in Blockchain, like so many other publications, reports daily on the rapid developments in the space. There’s no seeming end to the problems blockchain is able to tackle, and we all marvel at the solutions it can provide.

As professionals in the blockchain industry, our editorial team is immersed in a world that’s a long way from going mainstream; it’s more like gazing into a crystal ball. We have the privilege of witnessing the birth of disruption across all industries that will change our world as we know it.

As an investor, chances are that you invest not only money but your time and attention to learn more, keep up to date with and track the growth of this technological marvel that is the blockchain.

Depending on who you surround yourself with, it might seem as though everyone’s in on it these days. Yet – and how’s this for privilege? – less than 1 percent of the world is currently invested in cryptocurrency or blockchain technology. And the beauty of this technology and the economic opportunities it brings is that it’s not the same 1 percent leading the income race.

Focus on the Pressing Problems

Hollywood gave rise to formidable villains who proclaim that humanity is a menace to be eradicated, save for a select few in the survival of the fittest. And in the daily rat race, it is often a case of dog-eat-dog.

But at our core, we’re a species that cares. The RMS Titanic made famous the notion that in case of a disaster, women and children are to be saved first, for they are the most vulnerable. Most of us don’t need to be convinced of this morality; it’s ingrained in our DNA. To consider those less capable or fortunate than us is not a weakness, but an inherent strength.

If we shift this thinking to the blockchain industry, we come to appreciate that while there are many trendy products and projects tantalizing our first-world wants and needs, the world needs blockchain to solve our most pressing problems, including those of the 3.6 billion people who are the bottom half of the world’s population.

Telcoin: Bringing Financial Inclusion to Everyone

There aren’t, as yet, viable and scalable solutions to completely eradicate wealth disparity and economic exclusion. But the only way to eat an elephant is bite by bite.

Telcoin is not merely yet another blockchain startup. The company has made it their mission to pick a very big elephant in the room. In what will possibly be one of the greatest contributions of their lives, the talented Telcoin team will serve the world’s underserved.

Through their groundbreaking approach to blockchain utilization and deployment, Telcoin will leverage the technology’s ability to be the alternative that the world needs to address some of its inequalities. Financial inclusion is not the entire answer to the complex problems plaguing humanity but it’s a crucial cornerstone step.

What is Telcoin?

Articles detailing the rise of mobile everywhere across the planet are abundant on the internet and the media.

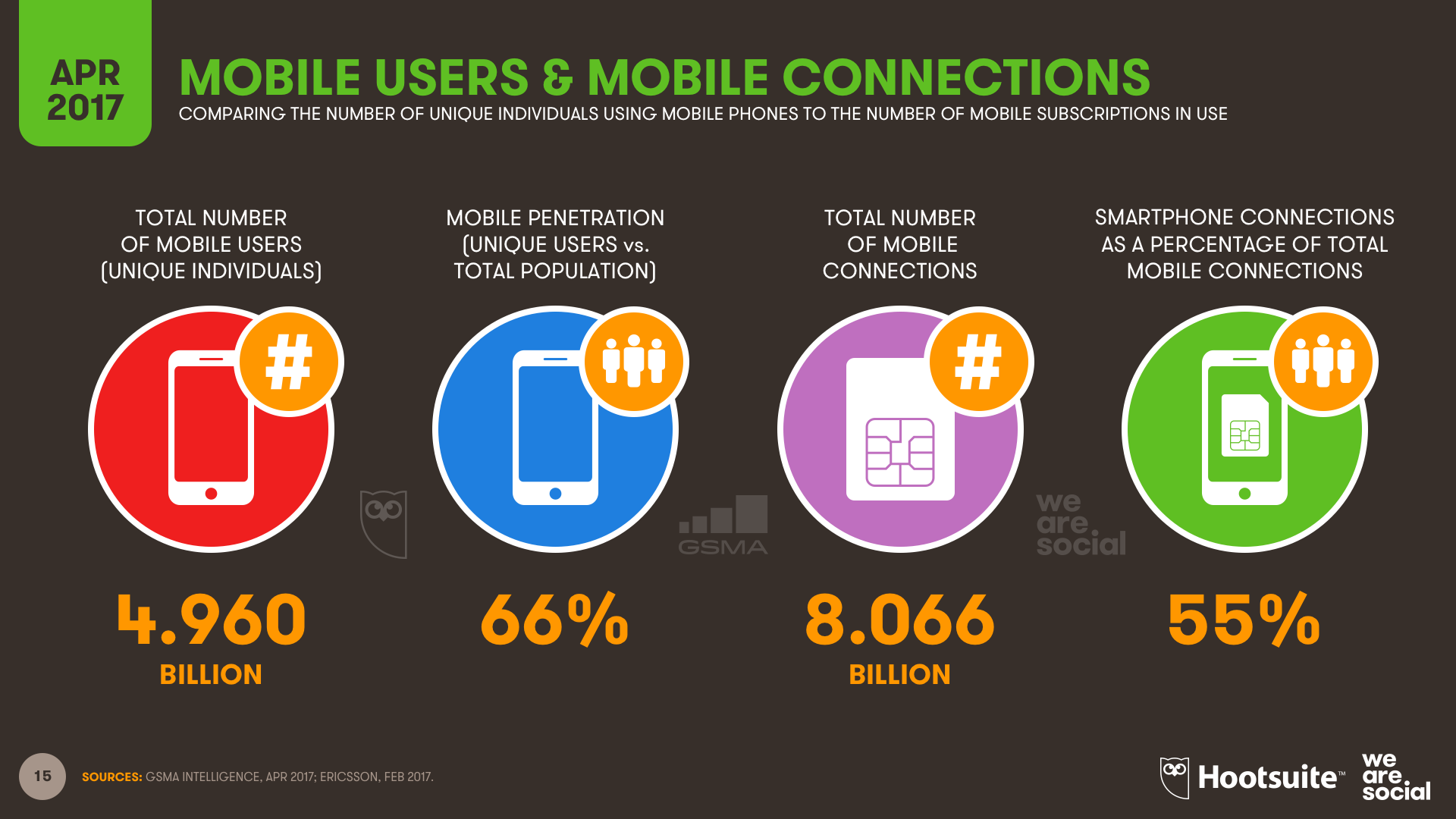

InJanuary 2017, We Are Social and Hootsuite reported a 66 percent mobile penetration. By April, another 43 million unique users had joined. And 4 months later, a Q3 August roundup revealed that another 92 million people added themselves to the club.

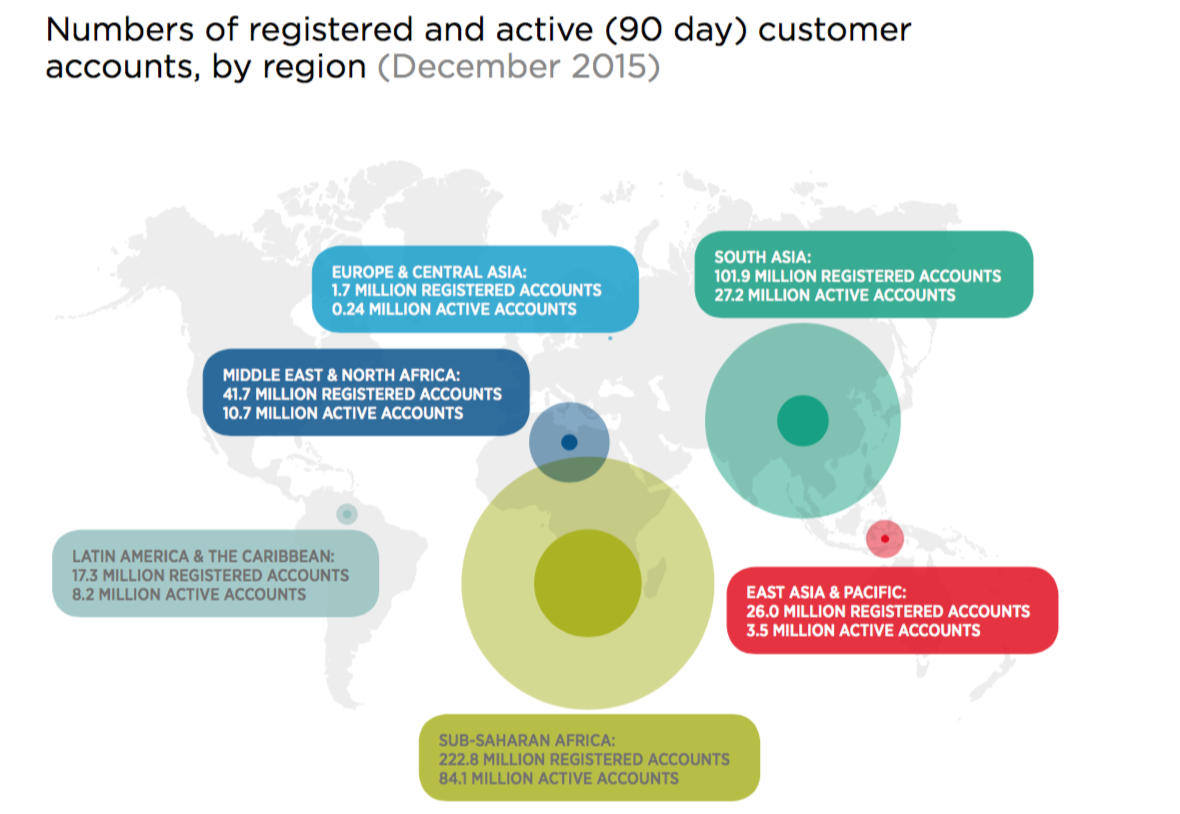

In emerging markets, mobile dug the foundations, and mobile money has paved the way. By December 2016, there were 277 live mobile money services in 92 countries, according to a report by GSMA. On a continent like Africa, mobile money is an important economic tool. And telecom operators are profiting, too. According to a McKinsey report, Africa’s two leading mobile money operators earned a combined US$750 million in revenue in 2016.

Now, thanks to Telcoin, we can finally paint road markers on the tar.

Telcoin is a cryptocurrency, but the product is so much more than that. It will be a solution for millions – and perhaps, ultimately, billions – of people who own very little other than their mobile phones.

Telcoin is a telecoms cryptocurrency, and that’s an important differentiation. The company will partner with telecom operators in developing markets to enrich their mobile money portfolio and include cryptocurrency in their service offerings.

Why Cryptocurrency

Why do vulnerable communities need a digital currency that proportionally few people can fathom, let alone those who don’t even own bank accounts?

For precisely that reason.

Mobile money has shown that in markets which are as exclusionary as they are resourceful, individuals don’t need to follow the well-trodden economic development path we hold as standard issue. That is, you don’t need a bank account to make use of financial services.

But due to its inevitable link to fiat currency, mobile money is still irrevocably connected to the problems that underpin this system. Cryptocurrency and its distributed ledger foundation offer an alternative that has been designed to bypass some of the most problematic elements of a fiat-based economy, including the middlemen who profit from every in-system financial transaction on the planet.

How Telcoin Works

Telcoin has done its due diligence. On one hand, there are mobile network operators in almost all emerging markets. These companies play crucial roles in the lives of the communities they serve, not only in terms of connectivity but through the mobile money services they provide. Essentially, these services make those economies run smoothly in the absence of traditional banking services.

On the other hand, people in emerging markets are making necessary use of services, like remittance, that cannot easily be disrupted by mobile money in its current fiat-dependency. This is because fiat itself is dependent on oft-expensive third party involvement.

Thanks to Telcoin, these two market factors can integrate in such a way that it not only benefits the bottom line of partnering telecom companies but also those people who have to turn over every cent, thrice.

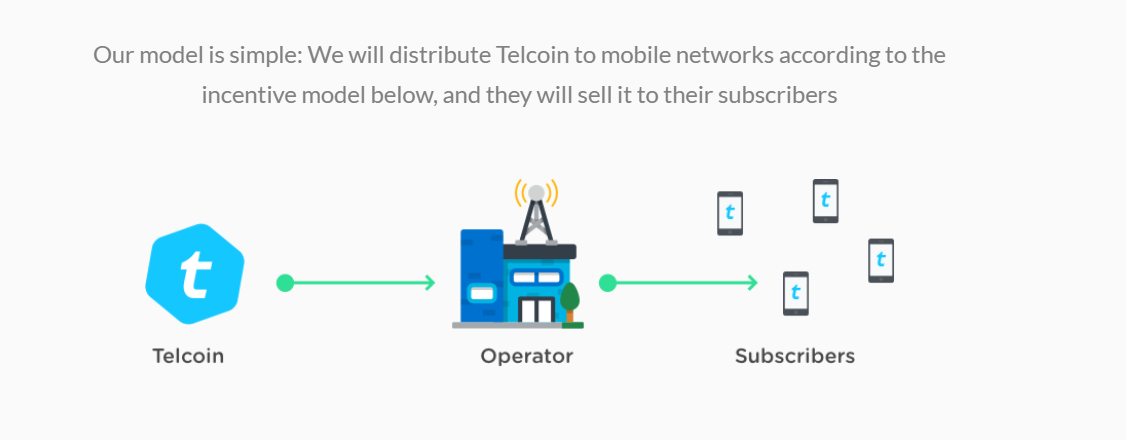

The process is elegantly simple: Telcoin distributes cryptocurrency to its telecom partners who, in turn, sell these tokens to their user base. Moreover, thanks to their telecom operator incentivization model, Telcoin’s dedicated focus on trust, reach, and KYC (Know Your Customer) compliance will be elements crucial to their market success.

On the back of this ecosystem, Telcoin is then able to introduce a variety of applications that answer their target market’s most pressing needs. This includes remittance (the company’s first use case), access to cryptocurrency (base expansion is key to the global mainstream adoption of virtual currency in some form or another), international aid, and even roaming spending for international travel.

In subsequent articles, we’ll look at the technicalities driving Telcoin, as well as its role in disaster relief, one of the company’s most revolutionary use cases.

The Telcoin ICO

Telcoin’s ICO will be live from December 11, 2017 to February 11, 2018 (or whenever their US$25 million hard cap is reached). Telcoin tokens can be purchased with ethereum (ETH), bitcoin (BTC), or fiat.

For more information, visit https://www.telco.in/ico/, follow them on Twitter, and join their Telegram group.