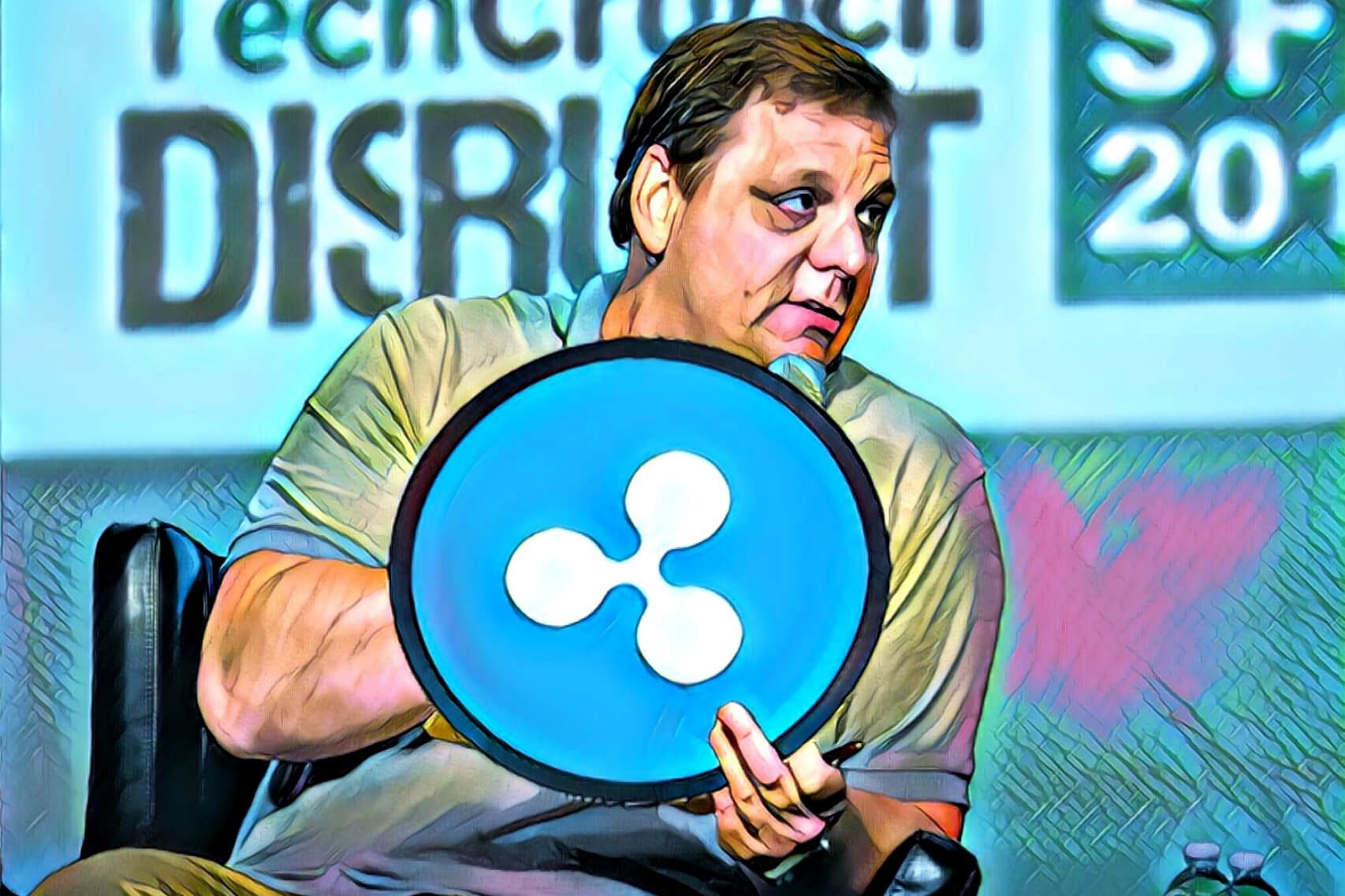

Arrington XRP Capital, a fund launched by TechCrunch founder Michael Arrington, has surpassed its $100 million funding target after it had received a $30 million investment from one of its limited partners, the fund announced.

The influx of funds has allowed Arrington XRP Capital to purchase ByteSize Capital, an Australian blockchain fund, and its founders Ninor and Ninos Mansor have joined the former as partners.

Ninos Mansor is optimistic of the experience that Arrington possesses:

One thing that stood out to us as we discussed a merger was the fact that they’ve been working together for over a decade. Two tech booms gives you scars and judgement that you just can’t replicate.

Arrington told CoinDesk that the injection of funds is very welcome, and that the performance of the fund, despite the bear market that set in last year, was not so worrisome given that the fund had performed better than the market:

The reason is, like everyone, we didn’t do particularly great last year, but we did better than the market. And that was a win.

He is also hopeful of how ByteSize’s expertise can be useful for the fund as it attempts to make the most of an uncertain market, saying that the Australian entity’s proprietary market analysis tools would come in handy:

We are seeing a new market. It’s not 2017. It’s not 2018. Funds like ours will continue to find ways to make money in markets that are unpredictable. We didn’t have the DNA to do trading, but now we do with these guys.

The announcement explains how Bytesize’s own tools will enhance Arrington’s existing investment strategies:

As part of the merger, Arrington XRP Capital will onboard ByteSize’s proprietary investing suite. The partners at ByteSize have developed a set of tools for navigating the crypto markets, including systems for data ingestion and quantitative backtesting. These systems will be incorporated into Arrington XRP Capital’s existing investment framework.

The goal is implement a “barbell” strategy wherein venture capital investments are carried out in a balanced manner alongside crypto trading.

With the acquisition of ByteSize, Arrington XRP Capital’s portfolio grows even larger.