The price of Ripple’s XRP cryptocurrency is finally beginning to reflect the tremendous amount of partnerships and developments Ripple has accomplished over the course of 2018 and the beginning of this year.

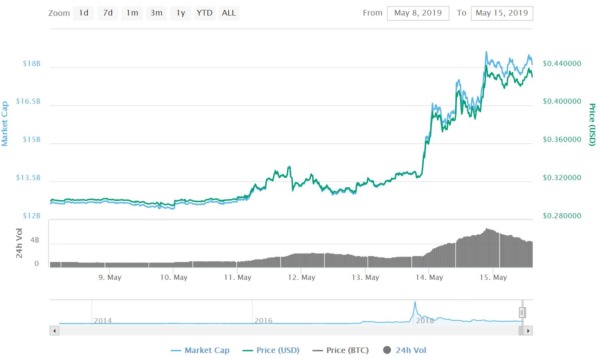

XRP is currently trading at $0.43 after finally breaking above $0.30 on May 11, representing a 40% plus increase in just 5 days. This is significant, considering XRP traded around $0.30 for much of 2018 and most of 2019.

Ripple’s XRP Can’t Be Ignored Any Longer

While XRP was hanging low, Ripple was busy building, developing, making partnerships, and collaborating with the most influential financial institutions and organizations in the world.

For instance, Ripple took advantage of their time outside of the limelight to rope in partners for their global blockchain payments network, RippleNet, and to convince entities to use their XRP-powered xRapid technology for cross-border payments.

The firm now has 10 financial institutions that are actively using XRP, and they are reporting savings of 40–70%, with near-instant transaction speeds that just aren’t possible via traditional payment methods.

The World Bank also highlighted Ripple’s achievements, praising xRapid for its improvements in remittances, in their report about Distributed Ledger Technologies (DLTs) for cross-border payments.

Moreover, Ripple is partnered with over 200 institutional clients that are using RippleNet. While most of these clients facilitate cross-border remittances through Ripple’s xCurrent payments technology (which doesn’t utilize XRP), Ripple has now launched the xCurrent 4.0 upgrade for XRP integration.

This is a bigger deal than most people think, because it allows all of Ripple’s existing and future xCurrent clients to utilize XRP through xRapid. It will now be easier than ever before to convince and migrate institutions over to use XRP.

What makes this aforementioned development even more exciting is that Ripple recently partnered with Euronet’s subsidiary Ria Money Transfer to enable instant, blockchain-powered global payments.

This is a big deal because Ria Money Transfer is one of the largest money transfer businesses in the world, with $40 billion in transfer volume per year in over 155 countries across 377,000 locations.

And There’s So Much More

he International Money Fund (IMF) is yet another financial giant in bed with Ripple. Ripple co-founder Chris Larsen was selected by the IMF to join a highly influential panel of 20 experts and leaders in finance and technology to discuss new innovations and their applications to finance.

As if being included on a panel hosted by the IMF wasn’t enough, Ripple has become one of the founding members of the European Commission’s blockchain association, called the International Association for Trusted Blockchain Applications (INATBA).

Furthermore, Ripple’s CEO Brad Garlinghouse once revealed that the Bank of England is a paid Ripple customer, and just during the recent Innovate Finance Global Summit, the Governor of the Bank of England said there was opportunity for the use of Ripple’s technology.

All in all, Ripple is deeply involved with the inner workings of the global financial system through a multitude of collaborations and partnerships with influential financial organizations. People are beginning to realize this, and it’s becoming clear that Ripple and XRP can no longer be ignored.

When do you think we will experience the real effects from all of the collaborations and partnerships with the financial giants mentioned above? Let us know what you think in the comment section below.