There are many different paths you can take to achieve personal wealth. You can do it by climbing to the top of your field in a high-paying profession, such as law, medicine, or engineering. You can also build it from scratch by creating something valuable for society as a successful entrepreneur.

Statistically speaking, however, you probably aren’t going to take one of those paths to riches. These success stories typically come with steep learning curves, very long hours, and tons of stress. Not everybody’s cup of tea.

Fortunately, there is another conventional path to wealth that comes without the heavy baggage.

That path, of course, is investing.

How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.

— Robert G. Allen

Indeed, many a millionaire got to where they are simply by making a decent living and investing a big percentage of it into high-yield assets. Meanwhile, whosoever doesn’t make their money work for them gets left behind – especially if they aren’t making a ton of it to begin with.

To really drive the idea home, let’s do a quick comparison.

A traditional savings account will probably earn well under 1% APY (Annualized Percentage Yield). If you account for inflation, then you are actually losing purchasing power by having your money sit in the bank.

To the contrary, the S&P 500 – an index of 500 of the largest US companies that are listed on the New York Stock Exchange (NYSE) or NASDAQ – has an average annualized return of just under 10% since its inception in 1928. Even after accounting for inflation, that’s still over 7% growth per year.

At that rate, a $10k investment made in 2000 would now be worth over $50k. A $50k investment in the same year would now be worth about $270k. And a $100k investment in 2000 would be worth well over $500k today.

The point is, compounding interest is your best friend if you give it enough time. Invest what you can, as early as you can, and you’ll reap the rewards later on.

Now if you’re saying to yourself, “I want to invest, but I don’t know how…” then this article is for you.

(Note: If you’re already familiar with tokenization and accredited investor laws, you can skip the next 2 sections.)

The Benefits of Tokenized Securities

A majority of the best investment vehicles out there can be classified as “securities.” These are financial instruments that have value and can be traded, such as stocks and bonds. They can additionally provide various financial rights to their owners, including equity, dividends, and interest.

Simple enough, right? Now, here’s where blockchain comes into the equation…

Using a blockchain, these financial instruments can be represented as digital tokens called tokenized securities. In fact, there are a number of cryptographic standards for this process.

One that we’ve covered before is the SRC20 protocol — a tool developed by a blockchain project called Swarm.

The purpose of the SRC20 protocol is to serve as a framework to make securities purchasable, sellable, and transferable in a straightforward and legally compliant manner. Like any good standard, SRC20 also helps simplify and expedite the entire tokenization process.

Another promising project in the security token space, Polymath, has developed their own standard, named ST-20. Like SRC20, ST-20’s main purpose is to make sure that the buying, selling, and trading of security tokens are compliant with government regulations.

Thanks to the work being done by Polymath, Swarm, and others, securities are becoming more liquid (i.e. easier to convert to cash), more transparent and traceable, as well as easier and cheaper to trade once they are tokenized.

On top of that, the use of blockchain technology enables the emergence of a whole new class of securities that are programmable, just as blockchain enabled the first programmable money with Bitcoin.

Because they are programmable, tokenized securities can have many of those financial rights of ownership fully automated. For example, the dividends payments of a stock can be carried out accurately and instantaneously through a smart contract, with no need for human interference.

Moreover, rights of the stockholder, such as voting on the decision making of a company in which they own equity, can be done transparently and securely on the blockchain.

Tokenization is still a nascent concept, with much to be learned in the years ahead. But the potential is certainly there for this to be perhaps the most transformative of all of the applications for blockchain technology.

Unfortunately, it’s not all sunshine and daisies. There are still some significant hurdles to overcome in making tokenized securities a revolutionary technology, the biggest of them perhaps being regulatory restrictions on investors, some of which probably impact you.

What Are Accredited Investor Laws?

If you are a resident of the United States, Accredited Investor laws will limit the investment opportunities that you have access to.

These laws are laid out in Rule 501 of Regulation D of the Securities Act of 1993. They state that in order for an individual American citizen to invest in certain securities, they must meet some special criteria:

- Have an individual net worth, or joint net worth with their spouse, exceeding $1,000,000. Note that this doesn’t include the value of their primary residence.

- Have an individual income in excess of $200,000 in each of the 2 most recent years, or joint income with their spouse in excess of $300,000 in each of those years, with the reasonable expectation to continue the same income level in the current year.

In other words, your income/net worth needs to be in the top 2% or so of the population to qualify.

Unfortunately, prospective investors outside of the US don’t have it all that much better. National Instrument (NI 45-106) makes essentially the same Accredited Investor requirements for Canadian citizens.

Meanwhile, the UK and European equivalent of an Accredited Investor is called an “Experienced Investor,” but has a similar requirement of €1,000,000 net worth as laid out by the UK’s Financial Services Act 2012.

Ultimately, if you are a citizen of the West then there’s almost certainly a regulatory body somewhere restricting your investment opportunities. Fortunately, all is not lost!

Thanks to tokenization, the insider-only world of private equity is being disrupted, and you can join in the fun.

How to Invest in Security Tokens if You Are a Non-Accredited Investor

Hopefully we aren’t too far away from a world in which the best investment opportunities are accessible to more than just the already-wealthy insiders who currently benefit from exclusive access to them.

After all, it would be a shame if the blockchain industry couldn’t succeed in democratizing investment for the masses. With each passing week, that outcome seems more probable.

In addition to projects like Swarm and Polymath that were briefly mentioned earlier, there are several other prominent projects in the tokenization space:

- Ravencoin – like Bitcoin, but for transferring assets rather than currency. Noteworthy points include no ICO, no pre-mine, no CEO, and ASIC resistance.

- Harbor – similar to Swarm and Polymath, with their own ERC-20-compatible and regulatory-compliant token standard, the R-Token Standard.

- OpenFinance Network – a regulatory-compliant platform for trading security tokens. Partnered with Harbor, Polymath, Swarm, and many others in the security token space.

- Coinlist – a platform focused on regulatory compliant token sales, helping clean up the scammy reputation of ICOs.

All of these projects, among many others still, are contributing in some way or another to tokenization infrastructure and laying the groundwork for democratizing investment and improving market efficiency.

Another thing they all share in common is a focus on regulatory compliance. For now, that means that they must adhere to securities regulations such as Know Your Customer (KYC), Anti-Money Laundering (AML), and Investor Accreditation.

That doesn’t mean that any of these projects support regulations that limit the investment opportunities of typical citizens. To the contrary, all of these projects understand that it’s better to sacrifice the small battles in the beginning in order to win the long-term war of truly democratizing investment.

In the meantime, here’s the good news: there is a way to work around Accredited Investor laws.

Specifically, Regulation A+ (Reg A+) exists so that small and early-stage companies can get access to the capital they need to grow, and raise that capital from accredited and non-accredited investors alike.

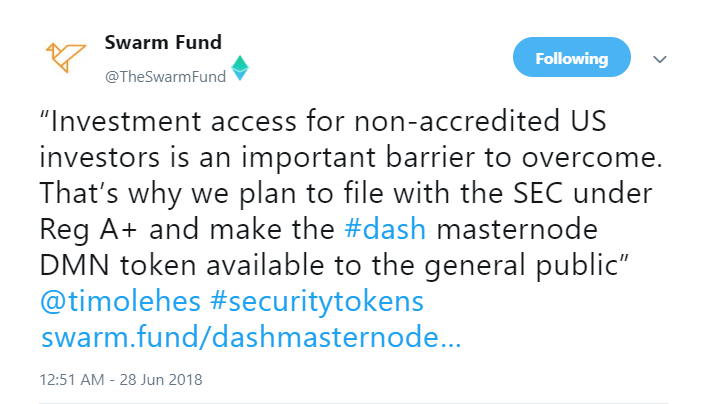

So far, the Dash masternode is the only security token offering available to non-accredited investors. There is reason to be encouraged about more future opportunities, however, as all tokenized securities projects will be looking for chances to file under Reg A+ whenever it makes sense to do so for the particular security.

As more and more assets get tokenized, that should become increasingly common over time.

That being said, what’s still by far the easiest way for non-accredited investors to gain exposure to securities right now is to invest in the infrastructure projects themselves, such as Swarm’s SWM token, Polymath’s POLY, Ravencoin’s RVN, and others.

Tokenized securities seem to be the one place where institutional investors and cryptocurrency investors can agree, and there is enormous potential for growth in the years ahead. The SWM and POLY tokens are as good a way as any for non-accredited investors to get involved in this most promising sector.

Take the Next Step

As always, our articles and other media you read should only serve as the very beginning of your research. If you want to invest some of your hard-earned money into this promising space, the next thing to do is to get to work reading white papers, using products where available, reviewing community forums, and learning as much as you can about both the individual projects and the space as a whole.

From there, you can hopefully pick out a project or two that stands out to you and invest in the project’s native token.

And if investing in the tokenization protocols doesn’t satisfy your tokenized securities itch, then we recommend that you follow our Swarm Platform Review, which will guide you through the registration and investment process so that you can invest in any securities filed under Reg A+, such as the Dash Masternode (DMN).

Below are some more resources to help you get started in your research:

To learn more about Polymath, check out What is Polymath (POLY)? and take a look at their blog for more technical coverage.

For more on Swarm, you can read our guide: What is Swarm (SWM)?, or check out the Swarm blog if you’d like to go deeper into the technical side of things.

As for Harbor, we recommend you read this introductory article that explains the R-Token standard and introduces the project’s team.

And if Ravencoin has piqued your interest, you can find an overview of the project in our article about low market cap altcoins that are relatively undervalued or browse their website.