Having touched on the Lisk platform and the consensus algorithm, we turn our attention to the Lisk cryptocurrency itself, traded as LSK.

Since the word “cryptocurrency” first entered common vocabulary, no one expected a deluge of other cryptocurrencies to come into the market so quickly. But this has happened, and the result is that there are hundreds of dead altcoins and cautionary tales.

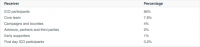

But Lisk is different. After an incredibly successful ICO in 2016, the value of the LSK token has steadily increased since the network went live on May 24, 2016. During the ICO, 100,000,000 LSK were distributed to the following groups:

Lisk brands itself as the “the first truly modular crypto-currency”. If this doesn’t immediately make sense to you, no stress, you’re not alone.

Below we’ll expand on this meaning and break down another segment of a brilliant infographic created by Kylefromohio (and current Lisk delegate). In doing so, we’ll shed further light on what makes Lisk unique and give a thorough rundown of LSK coin supply.

What is a “Modular Cryptocurrency”?

As the name suggests, this coin involves “modules” that serve as the basis of its design and construction. The concept of using a modular cryptocurrency is explained thusly: “using sidechains to infinitely extend the scalability of a digital asset ecosystem without impacting the speed or performance of the core blockchain.”

In short, Lisk has potentially created the first truly scalable digital asset ecosystem by using sidechains.

Now, onto the infographic.

How Can LSK be Obtained?

If you missed out on the ICO, you can buy LSK on several major exchanges including Bittrex, Poloniex, and YoBit where LSK tokens can be exchanged for Bitcoin or another cryptocurrency.

Lisk delegates receive LSK from forging (think: mining) activities and through round fees. Round fees refer to transmitting funds, registering as a delegate, voting, and registering a multisignature.

Sending Lisk between wallets typically takes about 10 seconds to complete.

As you can see from the infographic, forging rewards decline as the years pass but are meant to be replaced by increased round fees. We’ve just gone past the end of Year 1, and the rate is now fixed at 4 LSK per block — 12.6 million total new coins.

As this process plays out, inflation will be cut drastically over the next five years. Again, referring to the graph, you can see LSK hits a peak of around 15% inflation in Year 1 and is projected to round out close to 0% by Year 7. A countdown to the next transition can be found here.

Although Lisk is not designed to ultimately be deflationary like Bitcoin, its supply model is potentially a very good thing. This gradual reduction of supply is standard for DPoS systems and lost LSK forging income should be offset by an increase in per share value (as well as transaction fees). If Lisk continues a positive development trajectory, the dynamics of supply and demand will be working in favor of LSK holders.

Something to note: a comparison with Ethereum was added in the image above to provide a bit of context, but this may not be a fair illustration for ETH as there are said to have numerous changes in the pipeline that would alter these facts.

Lisk Development Foundation, Wallets and Beyond

As announced in a November 26, 2017 news roundup, the Lisk foundation is in control of the following assets:

In the world of ICOs and extravagant promises, transparency matters.

Potential LSK holders should care about the above for two reasons. One, it demonstrates a degree of willingness to be open about financials. Two, the Lisk Development Foundation is in control of substantial assets including a large chunk of fiat currency which will fund the project for years to come.

Another nice thing about LSK is that you don’t have to download the full blockchain or node to own it. Lisk recommends their official Nano Wallet which “enables the user to send and receive transactions on the Lisk network and provides a simple user interface for more advanced features like delegate voting or registering a second passphrase.”

Lastly, when the (highly anticipated) Lisk Software Development Kit is launched, users will be able to create their own tokens to create monetary incentives for a new app or community. For example, if a developer created a gaming application on a sidechain, they could also then create a currency for in-game purchases. This is one of many possible use-cases.

Summary

There are many reasons to believe that LSK will follow in the footsteps of its relative ETH and blast into the stratosphere. But there are also a huge number of variables in the mix and how these play out remains to be seen.

Either way, understanding the dynamics behind the Lisk coin and the developments underway (link) at HQ is critical.

Recent news led to a slight decrease in LSK value which was met with some chagrin. But for all the hodlers out there, it represented little more than a discount — which segues perfectly into the final installment of our “Understanding Lisk” series: How to Get Started.