According to one Quora post, the number of worldwide crypto users is approximately 50 million. If correct, this represents less than 1% of the world’s population. This is a great reminder of the vast number of people and amount of wealth that is still out there, waiting to enter the space.

Spend enough time inside the crypto bubble and it can feel like everyone (and their brother) is already here.

The truth is they aren’t, and projects that are lining up to facilitate and capitalize on the next crypto wave(s) are worth paying attention to. For the newbie, the world of cryptocurrency can be confusing & intimidating, and it’s infrastructure still leaves much to be desired.

Enter First Crypto ETF (or FCTF), a digital asset management platform striving to create the “easiest entry in the crypto world” via a crypto exchange-traded fund.

First Crypto has created an ETF, which is essentially a basket of cryptocurrency assets that can be bought or sold on exchanges or in peer-to-peer platforms. In this way, an investor can get broad exposure to the market without buying 10 different tokens, monitoring them, and securing them on their own. Instead, just buy into the Crypto ETF and sit back.

Here is a brief video explainer of FCTF before we dive into the details surrounding this project.

The Opportunity – Building Future Infrastructure

The FCTF whitepaper refers to the current environment as the “Jurassic” stage of crypto ETFs. But it also notes that the surge of investor interest in crypto shows no signs of abating.

To quote the whitepaper:

Operating models, technology platforms and distribution channels need to be able to support future volume increases and be flexible enough to accommodate new product launches.

The First Crypto team (like many others) knows that crypto is here to stay, it’s evolving and there is still a large “herd” of people that has yet to arrive.

They’re banking on the fact that ETFs have been wildly popular investment products since their inception in the 1990s. To add some context, the “total growth of mutual fund assets between 2001 and 2014 was a cumulative 127%. ETFs grew by 2,279% over the same period.” ETFs are historically known for being low-cost and flexible, and there’s little reason to think the blockchain version of ETFs will be any less successful than their traditional counterparts.

Ten Currencies in One Token

For anyone who doesn’t know, an ETF is a portfolio of marketable securities that track an index of underlying assets, typically stocks, bonds, or currencies. An ETF trades like a common stock on a stock exchange and the portfolio copies certain (specified) market prices, similar to an index fund. If you’re unclear on the difference, here is a great explainer.

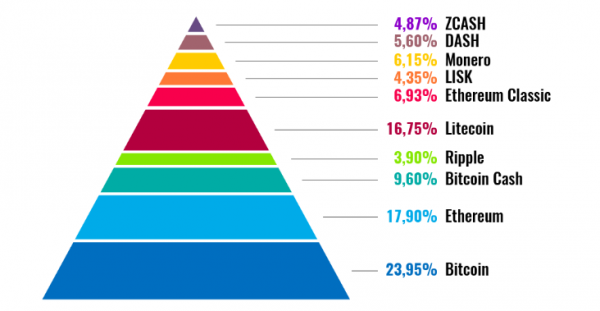

In the case of FCTF, the portfolio consists of 10 cryptocurrencies and the FCTF token is reflective of all assets therein. First Crypto’s ETF is referred to as the “Strategy Index” and it eliminates the need to have five or six differently wallets to handle all your coins — only one is needed as it´s an Ethereum-based token.

The first crypto EFT aims to offer 5 key benefits:

- Flexibility

- Diversification

- Affordability

- Efficiency

- Technical sophistication

The Authorization Engine

The price of the FCTF token is pegged to the value of 10 coins, all managed by a “smart authorization engine,” a technology that knows exactly when and how much to buy to keep the portfolio balanced. According to the team, “this technology helps analyze markets and make smart decisions when and where to buy/sell.”

It can be thought of as akin to AI in the world of currency trading. The authorize engine is a proprietary technology with its own encoded software solution. This technology was built by the team from Vacuumlabs, who’ve previously worked with Cardano, biometric security projects, booking portals, and a few jobs for Raiffeisen Bank.

The Singularity-X Exchange

First Crypto is aiming to solve liquidity problems by providing another way to easily get money into the market and move it around. There are no entry or exit fees, just a fixed 2% p.a. management fee and holders pay only a part of that fee based on how long they’ve held the token.

The FCTF token can be traded on the Singularity-X exchange, which launched on May 1, 2018. The exchange platform will also eventually be connected to other liquidity providers, and the FCTF token will gradually get introduced to other exchanges.

For those wary of security, the First Crypto team had this to say:

The security of digital assets is ensured by a combination of hot and cold wallets, where only a small portion of assets remain in the hot wallet and the remainder is safely stored in a cold wallet.

The initial breakdown of First Crypto ETF portfolio has been announced and it looks like this:

These are highly desirable coins, including the biggest names in crypto. The FCTF fund is an effort to represent the core of the crypto market and the inclusion criteria focused on many factors, including daily trade volume and liquidity.

The Black Card

First Crypto is also offering an OTC product that makes accessing the ETF even easier for users.

The Black Card can be purchased via fiat on the official website and it will be loaded with a “pre-defined quantity of ETFs, representing a basket of crypto-currencies and delivered with password and seed phrase under the highest security standards.”

Dash Masternode – Dividends For Token Holders

In a recent Medium article, First Crypto announced plans to establish a Dash masternode. Running a masternode on the Dash network is similar to being a Bitcoin miner, in that it plays a key role in which data gets added to a new block (and is subsequently rewarded for its actions).

In the case of Dash, 45% of the fee generated by the creation of new blocks goes to the masternode.

First Crypto ETF will immediately reinvest these coins into the ETF, and in this way will be regularly paying out a form of dividends. According to CEO Peter Vrábel (also quoted in the Medium article):

the mining fees earned from the masternode are a great way to add additional value to the Strategy Index.

Trust and Transparency

If you plan to put your money into an investment vehicle, it’s important to trust the creator of it. This is largely true even in a trust-minimized blockchain world.

It’s not hard to trust a product with a name like Goldman Sachs or Charles Schwab on it. The problem is these older, more established players are not at the forefront of the crypto revolution. This revolution has been driven (among other things) by scrappy startups and retail investors.

So it means that people can’t really rely on big names. This also means it becomes even more critical to figure out who you can trust.

In this sense, First Crypto is working hard to demonstrate their trustworthiness. Under the mantra “transparency, transparency, transparency,” the company complies with all KYC/AML rules that apply in the European Union. They’re also lining up one of the big four accounting firms to conduct auditing.

Why go to such lengths? According to them:

We want to guarantee to all involved parties that the contents of the currency basket (the ETF) match the number of coins in our portfolio.

First Crypto also has plans in place to publish a portfolio composition files outlining the precise contents of its portfolio on a daily basis.

Final Thoughts

First Crypto ETF (FCTF) is a fund with a unique platform, using blockchain technology and a proprietary authorized engine, to help bring cryptocurrency to the masses. Obviously, there are a number of similar projects underway today so FCTF is going to have to fight for market share.

Although still in its early stages, First Crypto ETF has the potential to be another good option for traders who want to save money but also newcomers who don´t have a time (or knowledge) to analyze & track large numbers of coins. As always, don’t just rely on the opinions of others, be smart, and DYOR.

First Crypto is conducting an ongoing ICO that began in February, and to date they’ve sold over 5,886,002 tokens. Visit their website to learn more. To stay up to date, you can follow them on Twitter, join their Telegram or follow along on Medium.