It’s been a trying few weeks for nearly anyone holding cryptocurrency. On January 16, crypto-holders woke up to find that Bitcoin’s value had fallen by 15%, and had been followed by most altcoins. As prices continued to sink, widespread FUD caused people to panic-sell, and the moniker “Black Tuesday” sank in. With some altcoins plummeting by 40%, it seemed as though the bubble had finally burst; cryptocurrency’s heyday was through, and the Warren Buffetts of the world would have the last laugh.

Crypto-veterans, however, pointed out that mid-January always brings with it a drastic slump in prices. Twitter user Armin Van Bitcoin even provided graphs showing similar dips and recoveries in the Bitcoin charts, dating back to January 2015.

There seems to be a pattern here. 🤔 #bitcoin #hodl pic.twitter.com/UOAfelOKcE

— Armin van Bitcoin ⚡ (@ArminVanBitcoin) January 16, 2018

So where does this yearly slump come from? Why do things seem especially dire this year? And how can a novice cryptocurrency holder best prepare themselves to ride out the storm?

The Holidays Are Over and Everyone’s Broke

It seems like such an ordinary explanation… but remember when Bitcoin dropped from almost $20,000 to $11,500 on December 22 (according to data provided by Coinbase)? People were cashing out en masse for money to buy gifts, and the shock wave was felt by crypto-holders across the globe.

When you consider Christmas and Hanukkah taking money out of the Western market through December, the same pattern occurring in Russia for New Year’s, and the same again for upcoming Lunar New Year celebrations in Asia, it might not be until the end of February before the market regains its upward trajectory.

Natural Correction to the Spike in Prices

We’ve been hearing the doom-and-gloom predictions since November, when Bitcoin started making headlines with its steep rise:

“It’s a bubble.”

“It’s unsustainable.”

“There’s going to be a correction.”

Well, consider this the correction everyone’s been waiting for, the reverse-swing of the pendulum we all have to ride out before the cryptocurrency market stabilizes.

The fact that this market correction is coming on the back of the January slump makes it seem more extreme than it actually is. In fact, as investor and blogger Jeroen Blokland points out, Bitcoin has a “crash” every quarter, and it always recovers, stronger than before:

Interesting to notice that this time a lot of mainstream analysts, economists and journalists are calling the end of the #bitcoin bubble. But these corrections have happened time and time again! ht @paulusa59 pic.twitter.com/dtCMRO5xBL

— jeroen blokland (@jsblokland) January 17, 2018

Panic-Selling Driven by Rumors and FUD

Anyone who follows crypto-themed news will know that rumors can spread like wildfire, and financial influencers such as JPMorgan’s CEO, Jamie Dimon, can wreak havoc on the markets by calling Bitcoin a “fraud” (he has since repented). In the last quarter of 2017, in addition to Wall Street doubling down on their efforts to discredit Bitcoin, there was a considerable amount of chaos coming from Asian cryptocurrency markets.

Across forums and social media sites, holders were sharing reports and rumors that China was cracking down on crypto trading. South Korea too has brought in new regulations on cryptocurrency, incorrectly reported to be a total ban – however, where South Korea will land regarding cryptocurrency regulations is still up in the air. Since these are two of Asia’s biggest crypto markets, the repercussions of this news have been felt on a global scale.

The revelation that certain South Korean government officials cashed out of their cryptocurrencies before the news of regulations were made public ushered in a public outcry – and a petition of 200k signatures calling on the government to reassess their stance on virtual currency. Given its popularity, and the sheer verve for mobilizing it inspires in holders, it seems unlikely that any government regulations will be able to dent the crypto-market for long.

New Investors, New FUD

One possible reason that the panic has been so, well, panicky is due to the increased amount of laypeople who have started following cryptocurrency in the past few months. Even experienced investors are unlikely to be prepared for the rollercoaster ride that is Bitcoin. And seeing other people on social media selling to cut their losses may scare them into cashing out as well – little do they realize that these people are probably also new to the crypto community, and they’re better off following the lead of those who have been around the block already.

Also, a lot of new investors are probably following the crypto markets on mainstream media, which is not always the most accurate when it comes to updates. Cryptocurrency still has something of a stigma as a niche interest, so by the time a story gains enough traction to be picked up by a mainstream site, it’s often old news. And of course, things move so quickly in the crypto world that by then the news may have changed completely.

How Do I Get Through This?

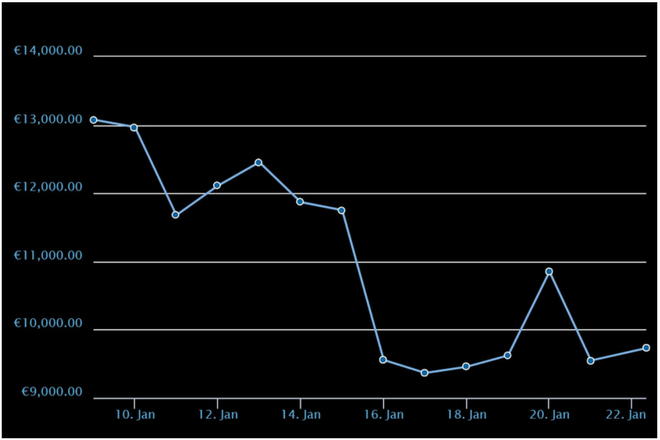

If, like most of us, you didn’t have the clairvoyance to sell your Bitcoin on January 6 and buy it all back on January 17, you may be suffering from an acute case of Bitcoin Regret Syndrome.

The best thing to do in this case is to look at the charts relatively: at the recent dip’s lowest point, Bitcoin was still worth a healthy $9,500. As little as two months ago, such a price would have had plenty of investors researching Lamborghini dealerships and drafting out lists of yacht names.

It also may help to remind yourself that, as of today, January 22, all signs point to Bitcoin being out of the woods.

[chart courtesy of CoinGecko]

[chart courtesy of CoinGecko]

The crypto market, for the most part, is in the green again, and the fact that the rise is a slow, steady one may be more comforting to those who couldn’t take the erratic swings of the past six months.

New investors who didn’t take advantage of the recent crypto upheaval can chalk it all up to a learning experience. The first rule of cryptocurrency (and, really, any sort of investing) is to never buy more than you can afford to lose. Still, if you compare charts for the top cryptocurrencies with those of January 2017, it would seem that there will never be a better time to buy Bitcoin than now.

And, of course, there’s always next January.