Blockchain is all the rage, yet investment and adoption levels remain small drops in a big ocean. To make the technology live up to its promise, we need a greater influx of investors and everyday adopters.

Is the banking sector, which already shows signs of strain under the rampage of blockchain disruption, the best place to start? This article looks into how cryptobanks might bridge the gap between where we are and where we need to go.

Crypto… Banks?

You know an industry’s going next level when it gets its own banking industry. Or so the saying could easily go. Because there haven’t been that many industries, to date, with the ability to create an alternative banking system. But then, blockchain isn’t just another industry: It’s an entirely new paradigm.

A cryptobank, circa 2013, was defined as:

… an online service for storing crypto currencies (such as bitcoins and litecoins).

In the fast-moving world of crypto, this definition has since evolved into a far more sophisticated solution, encompassing much of the services offered by traditional banks.

Thus, today a cryptobank, by this writer’s definition, can be defined as:

A blockchain-driven alternative to moving, storing, growing, and lending money, utilizing cryptocurrency assets instead of traditional fiat currency.

At present, the concept of cryptocurrency as a viable alternative to state-issued and -controlled fiat currency is still an alien concept. With the introduction of cryptobanks, this adds an entirely new layer of complexity.

The first question is, naturally, if a cryptobank is able to justify its existence by improving on conventional banks. Followed by the notion whether such institutions are really necessary (or even a good idea) when the whole idea around crypto is to do away with the middleman.

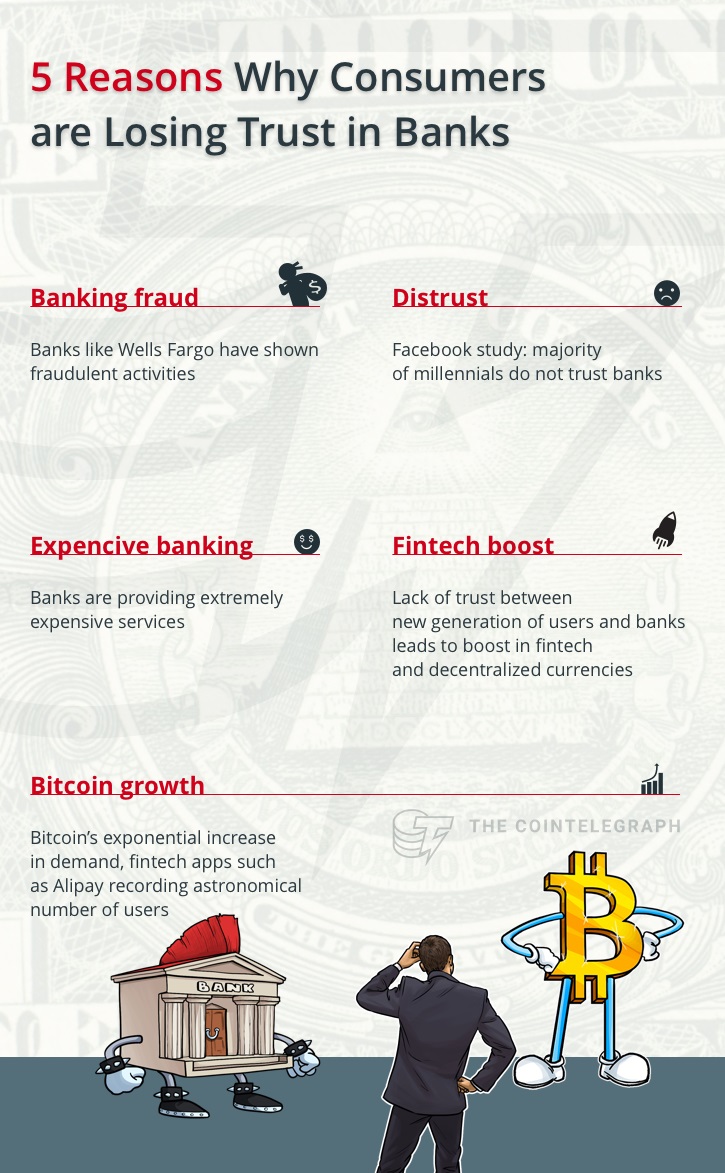

To attempt to answer these questions, we’ll look first at how cryptofinance has grown to give banks a run for their money, and why traditional consumer banks are falling short of customer needs.

The Rise of Cryptofinance

Depending on your perspective, the finance sector is faced either with an opportunity or a threat.

In population terms, cryptocurrencies are captivating monetary imaginations by the millions. In revenue, this stretches into the billions. Since its 2008 birth, Bitcoin could be well on its way to (one day) overtake the world’s total money supply.

Over on the blockchain business side, ICOs raised a global total of nearly US$4 billion in 2017. In Q1 and Q2 2018 alone, a further US$6.3 billion was raised through this new fundraising model, surpassing the total funds raised in 2017.

The crypto world is a fast-moving one. Mere months ago, JPMorgan Chase CEO Jamie Damon declared Bitcoin a bubble and warned he’d “fire on the spot” any employee trading cryptocurrency, before issuing a follow-up statement that “Bitcoin is real.”

In the company’s recent annual report, however, it’s clear the bank is aware that blockchain poses a business threat to the finance sector:

Both financial institutions and their non-banking competitors face the risk that payment processing and other services could be disrupted by technologies, such as cryptocurrencies, that require no intermediation.

While Dimon personally might have held the opinion that cryptocurrency is nothing but tulip mania, his company counts it as a force to be reckoned with:

Ongoing or increased competition may put downward pressure on prices and fees for JPMorgan Chase’s products and services or may cause JPMorgan Chase to lose market share.

From Traditional (One-Sided) Golden Years to a (Fair) Cutting-Edge Tomorrow

Another day, another blockchain use case. It’s the kernel of what makes this newfound industry akin to starring in a Hollywood blockbuster: there is endless action and exciting plots aplenty to make your head spin. For those who stand at the forefront of the industry as professionals and as investors, a clear pathway is being hacked out of what used to be an impenetrable jungle fortress traditionally reserved only for the rich and fiscally powerful.

Cryptocurrency and blockchain have been steadily siphoning revenue away from traditional stock market investing. Together, they are giving venture capitalism a run for its money, causing many to speculate on “the death of” such conventional finance avenues.

Yet with only a speculated 1% of the world’s population currently invested in blockchain technology, it’s plain to see that the rose-tinted glasses with which industry insiders view the future has a long way to go to becoming a mainstream fashion accessory.

Yes, blockchain is coming, and it’s leaving no stone unturned. However, in a world where everyone from forward-thinking pioneers to change-averse laggards needs to be accommodated to embrace such revolutionary change, the easiest way to eat an elephant is still one bite at a time.

For the moment, the elephant in the room (which has to be caught before it can be cooked) is a single question, often left unspoken: how do we reconcile an industry so cutting-edge that the artificial intelligence, Internet of Things, and virtual reality industries are all embracing it as their missing link, with the fact that most of the world population is either unaware of its existence, or wholly dazed and confused by it?

We Like CryptoKitties, But We Need Bread

Beyond the land of buzz and hype (which, admittedly, have been significant players in the attention lavished on blockchain), there lies a kingdom that forms the basis of any industry-specific or agnostic evolution: need. In the absence of solving a real-world need, anything is but a passing fad. Of course, the very reason blockchain tech is as disruptive as it is, is due to its ability to solve the hitherto unsolvable.

But to move past A (because, as much as we’d like to tell ourselves otherwise, we really haven’t even gotten to B yet) and get the world on board, we have to cover all our bases, not only those that satisfy our Bright Shiny Object appetites. We have to focus on need.

Our needs are many, and blockchain has the potential to cater to great scores of them. For now, the promising startups we follow are making waves with promises of every which industry they aim to disrupt. But until they mature to the point of showcasing the changes they pledge to effect, we’re all holding our breath a little, hoping (and praying, when our portfolios start dipping downward) that outcomes will match the money we put where blockchain startups’ mouths are.

Yet there is one industry that is being fundamentally, irrefutably transformed. (And we needn’t wait to see what — excuse the pun — ripple effects it has on the world as we know it… it’s happening in real time.)

In the blockchain universe, with its mighty cryptocurrency heroes that have been standing their ground against traditional finance since 2008, the Battle of the Banks is a key ongoing event.

It just so happens that in the midst of this faceoff, banking might hold the answer to widespread adoption.

No Wo/Man Left Behind: The Blockchain Decree

We’ve seen the Big Banks name and shame cryptocurrency, only to turn around and list it as a major business threat. We’ve had credit card companies block our ability to buy crypto (a sobering reminder that our credit and its masters own us). And central banks in countless countries have warned (if not outright prohibited) investors to steer clear of the Big Bad Wolf that is this menacing concept of unregulated digital currencies that answer to neither state nor bank.

The Che Guevara in us all stands proud: We are the resistance. We’re the ones making and shaping a tomorrow that offers options, a far cry from the banking monopolies of today.

Like any band of changemakers, we are the 1%. And we can’t do this alone. Not on the scale needed to completely transform the way things are done in every country and every industry on the planet. We need the other 99% to come on board.

And for that, we need to slow down our metaphorical spaceships and allow the horse-and-buggies of our slower-moving brethren to find parking space before they’re able to join us on the joyride. After all, we can’t expect them to fly up to meet us; they’re riding Colt, not Pegasus.

Bitcoin might be a major driving force in blockchain adoption from an investment perspective, but its limitations in real-world applications mean it isn’t exactly our best contender in the race to get the average person onto the blockchain to answer a tangible need.

And there are few modern-day needs as universal as banking. Banking has been positioned as a non-negotiable need for over 600 years. While cryptocurrency has shown us that this “need” is far more of an illusion than we’ve led to believe, for most of us the illusion still stands strong. It’s through this very doorway that we’re able to catch the attention of the 99%. Meet them where they are, then show them alternate doorways.

Speaking of needs, in banking, we have a few that we consider crucial: moving, storing, growing, and borrowing money. How are these faring now that blockchain’s shaking things up?

Moving Money

If you have a bank account, you have a built-in pet peeve: banking charges. While arguably small and insignificant at the micro-level, the higher the number of digital paper bills in your possession, the more significant those charges become when you start moving them in and out of your accounts.

For the unbanked, this poses an even bigger problem when seen in the light of remittances sent around the globe. In a situation where every cent counts, it’s a sorry state of affairs to relinquish so much of it for the “privilege” of transferring it from one party to another.

As blockchain’s most well-known application, cryptocurrency has proven to us that this is, in fact, unnecessary. Why pay so much to a third party (during a drawn-out process) when you could lower fees significantly by conducting a direct (and instantaneous) end-to-end transaction?

Storing Money

In the Old World, Europeans had their systems laid out for them. Everyone from feudal lords to chambermaids had their part to play, and said part was pretty much theirs for life, willingly or not. The New World saw Americans build “the land of the free,” where futures could be rewritten based on one’s ingenuity and wit instead of the heritage and (mis)fortunes that used to lock a person into a role for the entirety of their lifespan. The connection this history lesson has with banking and cryptocurrency is more relevant than you may think.

Up until recently, a savings account was understood to serve less of a money-saving purpose. Instead, the average account a bank refers to as a “savings” account — with account fees lower than that of a transmission or current account — is merely the modern-day equivalent of storing money under your mattress.

Some of it might be for a rainy day, but the majority of such funds will end up paying for anything from grilled cheese sandwiches to movie tickets, and what is called a “savings” account is actually more of a storage account.

Today, however, it’s no longer a peculiar sight (at least on the side of the fence where those of us initiated into the world of crypto graze) to see someone store money in their cryptocurrency wallets and move it into their bank accounts only when they want to utilize it for a non-crypto-friendly payment.

Sure, some days that crypto is worth more than on others, depending on which direction the arrow swings, but learning to feel comfortable amidst uncertainty is a skill to behold. In this New World of global finance, rules are being rewritten from the bottom up.

Growing Money

If only our parents’ exasperated “Do you think money grows on trees?” was a reality. But this isn’t the Chocolate Factory, and in the real world, Willy Wonka has to invest his money the old-fashioned way: the stock market, real estate, or — wait, was that an Oompa Loompa with an ICO in its hand? This way, folks!

Initial Coin Offerings — the stuff investor dreams are made of. 2017 was a year that went down in history as money flowed in coin after coin after coin, enabling countless startup teams to build The Next X on the blockchain.

2018 might have seen a significant calm-down (because things really did get a little crazy), but we’re nowhere near seeing the death of this. Quite the contrary. Never before has the average investor had the ability to invest in emerging technologies starting with as little as a US$0.10 investment.

Move over, venture capital. Stand aside, initial public offerings. There’s a new kid on the block(chain), and this block is headed for the moon.

Lending Money

Lending. Is there any other financial concept with which we have a greater love-hate relationship? Everything from our house to our car to — when need be — our cash flow is subject to asking another party (be it our brother or the bank) for a cash injection in order to afford or pay for our wants and needs.

Loans can set us free (if the purpose of our lending will ensure good returns, such as setting up a profitable business), or it can be the dead-set trap our parents warned us about, setting up a spiral of debt that becomes a bottomless pit. Since times immemorial, banks have been the ones to keep us enslaved. Can blockchain bring a new dimension to the party?

To Bank or Not To Bank, That is the Question

Ripple took the banking world by storm and makes a good case for banks to say no to SWIFT and yes to XRP for cross-border payments. Major banks the likes of Goldman Sachs and Morgan Stanley are moving to open their doors to digital currency for a digital world. The Rothschilds, Rockefellers, and George Soros are adding cryptocurrency trading to the list of family-friendly activities. Even for traditional institutions, such as those in the banking world, the adage seems to ring true: adapt or die (and in between, lose out on much potential revenue).

Since their inception in 1397, banks have found themselves in an enviable position. The concept of money is so intimately ingrained with banking that one cannot even state that banks have had a “monopoly” over finance. For the modern world at large, money has, by and large, come to equal banking.

The only competition a bank has faced have been other banks.

The custodianship banks have had over money has gone unquestioned, and the general public just about equates money with their banking overlords. If not for the 2008 global financial crisis or banking scandals every so often, such as that of Wells Fargo that recently erupted, we might well be forgiven for forgetting that the concepts are, in fact, interdependent. Not at all as dependent as we believe.

And then came blockchain, and the rest is history being written as we speak. For the first time in history, financial literates can actively choose whether or not to involve a bank in their monetary dealings. A greater spark to inspire a brand-new era of societal evolution could hardly have been asked for.

Meet Me in the Middle: Bridging the Gap

This brings us back to our original discussion: how do we go from 1 to 100?

The average person is not a financial daredevil, nor a trailblazer testing out the latest and greatest technological innovations to hit the market. Thanks to the time and tireless dedication by the cryptocurrency and blockchain community, we’re seeing a steady proliferation in investment rates in every world market.

While investing in blockchain is one thing, adopting its usage in everyday life is quite another. Most people, if asked, still fail to explain its usability. What the industry needs is to offer consumers clear-cut, easily understandable, intuitive, and user-friendly solutions catering to their needs.

While it’s the glitz and glam use cases that tend to catch the most media shine, we’re best served starting with the basics when looking at how to implement the technology into our stock standard routines. The best way to boil a frog is by putting it into water at a temperature it’s used to, after all.

Since money’s what makes the world go round, and the reigning perception is money + banking = 1, the sector is the exact place to look for needs to fill. Of course, that’s what blockchain’s been doing all along. But how do we take the newly (and not so newly) converted from investing in cryptocurrencies and ICOs to making blockchain an ingrained part of their daily? The answer might just lie in the rise of the cryptobank.

The Rise of the Cryptobank

Cryptobanking is a concept that takes traditional financial services and positions them for the crypto age. We live in dynamic, ever-changing times, and blockchain has brought a viable solution to the crying shame many of us knew we were living but were helpless to change: the fact that our systems, like our institutions, are archaic.

Before we explore the meaning of a cryptobank, let’s take a step back and consider the meaning of the word “bank.”

A bank’s job is to provide customers with financial services that help people better manage their lives. As technology advances and competition increases, banks are offering different types of services to stay current and attract customers. … This ensures you get the most out of your current financial institution.

A cryptobank, then, would provide customers with financial services that help people better manage their cryptocurrency portfolios … and their lives (for cryptocurrency is becoming as much part and parcel of our “lives” as fiat).

Additionally, a cryptobank would help you get the most out of using a single service (e.g. the cryptobank in question), which is in sharp contrast to the current standard of what feels like using 30 different service providers for every 2 altcoins. In turn, such a service offering would attract customers not only to the cryptobank in question but even, if they play their cards right, to cryptocurrency and blockchain as a whole.

While it’s early days yet (for blockchain as well as the notion of a cryptobank), this is a concept that is sure to gain traction in the near future.

What might a cryptobank look like? What follows is a look inside Lendo, a blockchain startup that, owing to its particular service offerings, serves as a good example of how a cryptobank operates.

Case Study: Lendo

Let’s revisit our banking checklist and apply it to cryptobanking. A cryptobank should be able to move money, store money, grow money, and lend money.

Lendo offers all of these, thus serving as the perfect case study for imagining a pathway between cryptocurrency’s current camping spot on the financial outskirts and a world in which a “bank” no longer implies only the 621-year-old sense of the word.

Lendo operates in the fintech space. On the surface, they offer what many other blockchain fintech companies bring to market, operating under what you’d consider a current account:

- A multi-currency crypto wallet, available on Android, iOS, and as a web app

- A debit card, linked to your wallet, to spend your cryptocurrencies anytime, anywhere

Bring the following into the mix, and it gets more interesting but is still a way off from qualifying for “cryptobank” status:

- A native global cryptocurrency trading exchange linked to your accompanying card and wallet

Perhaps this addition brings us closer to a qualifying definition?

- A savings account that rewards account holders for keeping Lendo’s native token, ELT, out of circulation on a month-to-month basis

- A merchant system that will allow businesses to accept payment in any of the above-mentioned currencies, with an option to convert to fiat immediately or keep a percentage or the full amount in crypto

Finally, there’s this. The big kahuna. The elements that drive home the “Aha!” moment: there is a life — growing and thriving — after conventional banking, after all!

- A credit account, consisting of a conventional credit card on which Lendo tokens can be “stored” (i.e. used as credit collateral) in addition to Bitcoin, Ethereum, and Litecoin, with more tokens to be added in future

- A fiat loan facility from accredited lenders using your cryptocurrency assets as collateral, the latter which will be stored in Lendo’s top-security cold storage and deep cold vaults. The entire process will, naturally, be driven by the power of immutable smart contracts

- A safety deposit account that will enable you to store your crypto in Lendo’s cold storage vaults

Yes, at last, that Bitcoin you’re hodling is worth more than its weight in gold or its future as a fortune maker. In a market where many of us have been pumping what spare cash we have into this coin or that, why suffer while we wait for that dream of hitting Lambo-status to materialize? At current count, loan applications via the Lendo platform tally €122,415,120, indicating that cryptobanks might just be banking’s next wave.

Lendo’s future expansion plans include the ability to

- purchase real estate

- invest in real estate funds

- invest in structured funds

- buy listed bonds

All of which are about as bank-oriented as it gets.

According to CEO David Honeyman:

We live in a digital world where mind-blowing technology such as smartphones have become utterly commonplace. And yet, some people are still resisting digital currency. If we were starting on a blank canvas and someone proposed today that we used paper money and metal coins as the core platform or store of value system on which to transact business, they would be laughed at. Digital currency adoption and all its related cryptobanking services have to take the sustainable route forward. Lendo aims to be the bridge between the crypto world and mainstream financial services, merging innovation with tradition and giving the consumer the best of both worlds.

Conclusion

I mimic this sentiment in just about every piece I write (and it’s not thanks to hitching a ride on the hype train, but because the facts are staring us in the face): blockchain is slowly, and with surprising stealth, transforming the face of the majority of our industries. Not every crypto user is using crypto to do away with middlemen at all costs. Cryptobanks, then, straddle two seemingly opposing worlds: One that’s been reigning for centuries, and one that’s steadily gaining traction as an alternative financial system.

The concept of a cryptobank, although still in its infancy, is a victorious win for the principle of individual sovereignty within the banking system.

Case in point: In 2012, we defined a “sovereign citizen” as “someone who believes that he or she is above all laws.” Today, we embrace it as “the concept of property in one’s own person, expressed as the moral or natural right of a person to have bodily integrity and be the exclusive controller of one’s own body and life.”

Thanks to blockchain, we’re even equating self-sovereignty with such concepts as the right to own our digital identities.

Do we need the banking system? For the time being, absolutely. Should it have an absolute monopoly over the world’s money and primary financial services? Absolutely not.

Related: Disrupting the Disruptor: 6 Exciting Blockchain Fintech Startups