Lisa Ellis, an analyst at independent research firm MoffettNathanson, holds a positive outlook on the future of cryptocurrencies. The industry insider, who has knowledge of how the traditional markets and payments processing system work, wrote a note to her clients about the effect digital assets could have on payment networks such as Visa, Mastercard and PayPal.

Ellis is a partner and senior equity analyst at the firm and has worked at Sanford C. Bernstein and McKinsey. Her background includes 2 decades of technology experience in verticals as mobile applications, cloud services and outsourcing.

Her perspective adds to the growing throng of incumbent voices who see cryptocurrencies as a legitimate upgrade of current systems.

Her note to the clients described how digital assets directly challenge these systems and contrast with them as they are decentralized:

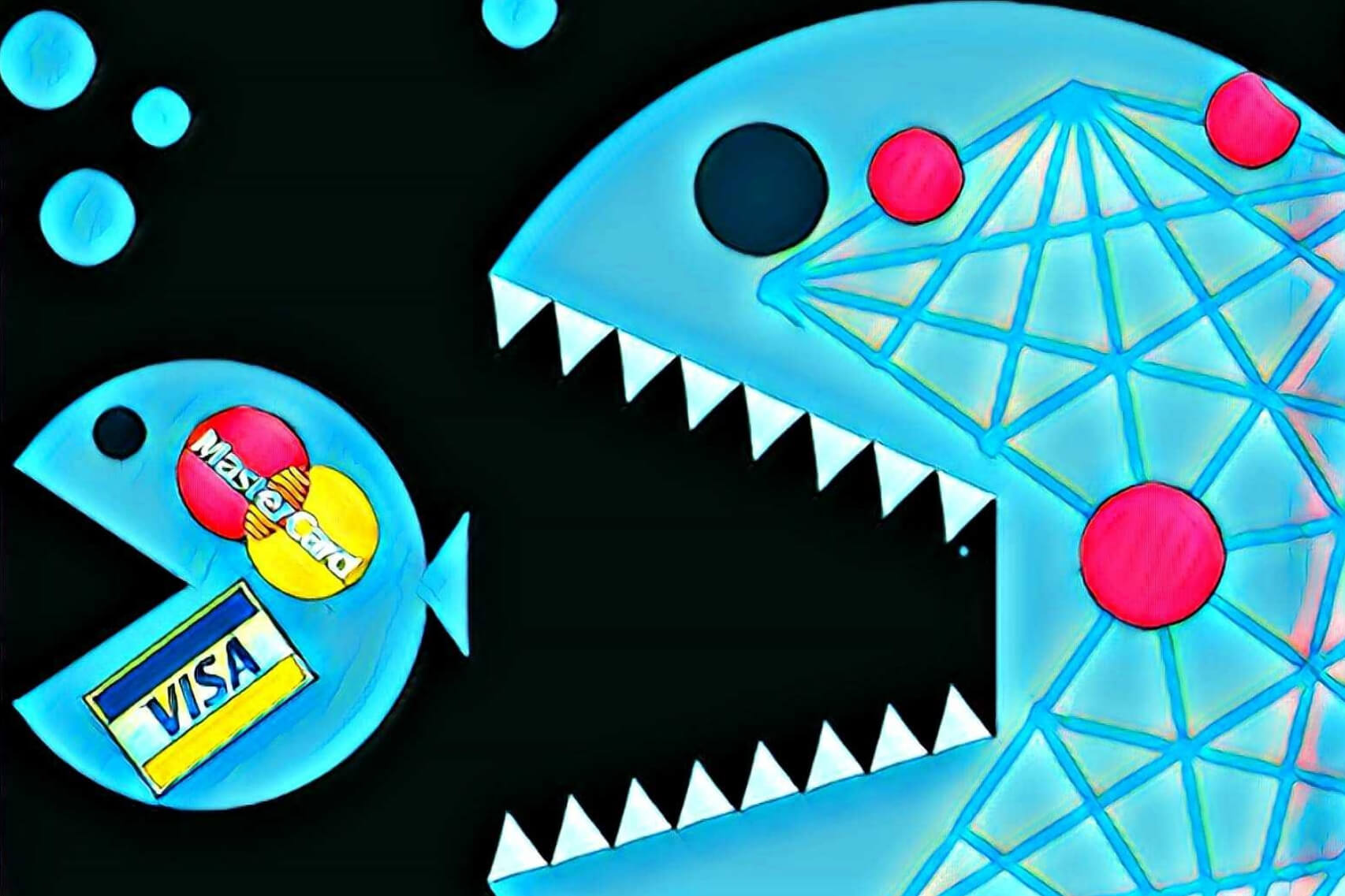

Cryptocurrency systems (e.g., Bitcoin, Ethereum, Ripple) are potentially disruptive to private payment systems. Their core design characteristics –- which are aimed at enabling ‘freedom of money’ — are in direct contrast to the characteristics of most traditional, private payment systems.

Though Ellis believes that there is a lot of disruptive potential in this technology, she does not think that the change is going to arrive soon.

She thinks cryptocurrencies are more likely to commoditize rather than disintermediate current payment systems entirely. Ellis also stated that if existing businesses do not embrace the technology, they stand to lose — especially with respect to businesses dealing with B2B and person-to-person payments.

While global adoption of crypto may not be around the corner, the point she made about businesses adopting decentralized technology is a strong one — there is a lot to be gained for those who leverage the technology and a lot to be lost for those who don’t.

Perhaps that’s why investment banks like JPMorgan Chase have launched their own cryptocurrency for clients, and why PwC and other such firms are looking into the technology themselves.

She also wrote:

Why would I ever buy coffee with Bitcoin?…[It may eventually happen] as ludicrous as it sounds.

With Starbucks working with Bakkt to accept Bitcoin for coffee, that future may not be as far as Ellis thinks.