The Coinbase team has announced that Coinbase Pro, the exchange’s advanced trading platform which supports features not available to the consumer platform, will experience several changes on March 22.

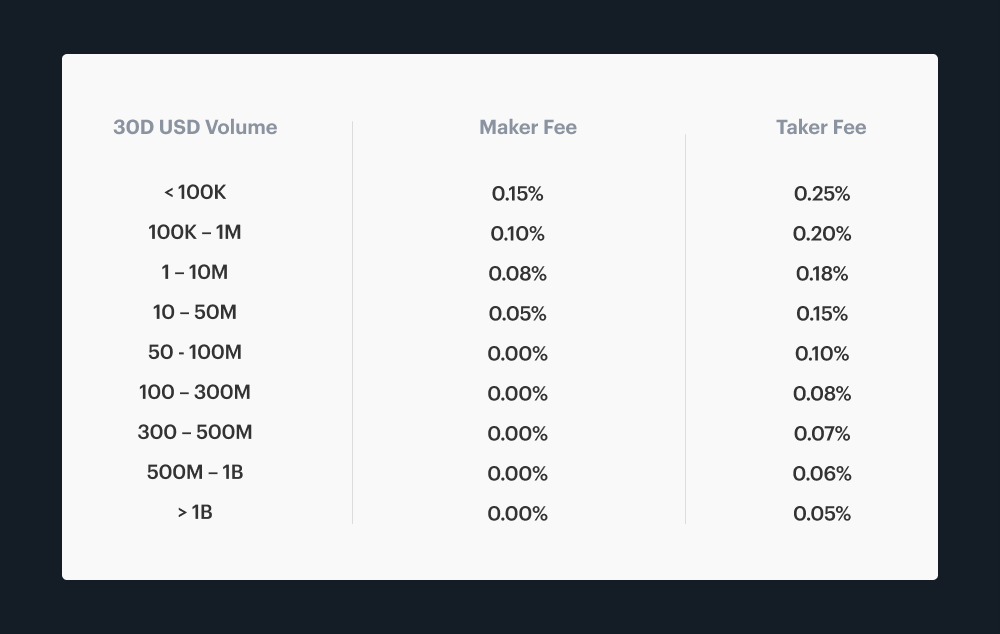

The changes, published in a blog post, are significant. The most notable of these is an update of the fees structure, which will now impose relatively high maker fees: 0.15% for those trading less than $100,000 over a 30 day period.

Coinbase’s maker fees used to be 0% and the new change reflects quite a hike in fees. However, it still remains cheaper than some other U.S.-based exchanges, like Gemini.

Other changes include updating order maximums to provide protection against large price movements, new order increment sizes, turning off stop market orders, and adding market protection points.

The Coinbase team provided the following reasons for the change:

These changes are designed to increase liquidity, enable better price discovery for trades, and to make price movements smoother. This will lead to a more efficient market and increase trading opportunities for all of our customers.

That said, the changes have riled up the crypto community.

In the past, users had taken to Coinbase Pro precisely because of the lower trading fees. The alteration to the fees structure means that users have little reason to choose between Coinbase and Coinbase Pro.

Naturally, Coinbase users have questioned whether the change was motivated by greed, at least to a degree.

Reddit user Voidward spoke of the new fees structure and attempt to curb volatility:

The claim is:

New fee structure that is designed to increase liquidity by reducing the delta between maker and taker fees

Hard not to assume there is not some element of greed involved. Removing stop orders and limiting market orders to not move the price more than 10% seems like it’s aimed at limiting volatility, but at the same time, people are probably not going to like going to sleep with open orders and no stop losses.

With such changes, users are considering closing their Coinbase account and trading on Binance instead, where the maker fees is 0.10%.

In recent times, crypto investors have been talking about — and some even going through with — closing their accounts, following the #deleteCoinbase movement on Twitter in response to Coinbase’s controversial acquisition of Neutrino.The situation was further exacerbated when it was revealed that one of its third-party tracking providers had sold client data.

The listing of the XRP token also drew some negative attention to Coinbase as Ripple had violated one of its listing rules.

If Coinbase is going to increase its prices for relatively low-capital investors, it will only bring further scrutiny its way.