Anyone who does not have a background in tech but has recently been caught up in the recent excitement over cryptocurrencies and blockchain technologies will have experienced the frustration of trying to get over the initial hump of understanding what it’s all about.

It’s not that the overarching concepts are especially difficult, or at least, no more difficult than the principles that outline the fundamentals of other technologies that we use every day, like email or websites.

The problem is more that the crypto space is dominated by tech enthusiasts who may be brilliant developers, but are terrible at explaining what they know to the general public.

All too often, they confuse the level of knowledge it takes to use something with the knowledge it takes to build something. No one needs to know how an email server handles SMTP requests in order to send an email.

Similarly, cryptocurrency shouldn’t require you to know how to build a blockchain in order to buy a coffee. Unfortunately, many cryptocurrencies and their related services get lost in a haze of explanations about the entirety of how it all works, with a hefty additional dose of explanations about associated ideologies of decentralization and privacy.

CitiCash wants to change that, with a wallet that has one primary driving focus: ease of use. As mentioned on their website, it should be accessible to everyone, even your grandmother. They also have a token, CCH, and ambitions to roll out merchant adoption, to help create the infrastructure necessary for a smooth purchasing experience in a store.

However, while those are all important components of the CitiCash offering, they are starting with the user experience first, and working backward – a principle that Steve Jobs was famous for espousing, which helped drive Apple to its position of prominence.

The CitiCash Desktop Wallet has just been released. Does it live up to their promise of usability?

Installing the Desktop Wallet

The CitiCash wallet is available for download now for the Windows platform, with Apple, Mobile, and browser wallets to follow.

Once you have the wallet downloaded and installed, you’re walked through a few basic steps to get going, starting with your preferred language. Currently, English, Czech, Italian, Russian, French, Spanish, and Chinese are offered.

With that out of the way, you’re then given the option to create a new wallet or restore an old one. If you already have a CitiCash wallet, then all of this is old news to you, so, selecting to open a new wallet, you’re taken to a new account screen. Here you have to create a username and a password, a process that will be familiar to anyone setting up any kind of online account.

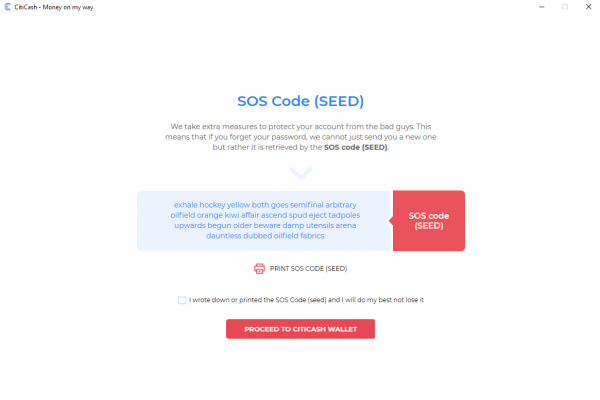

With the username and password set, you’re then prompted to save what the CitiCash wallet refers to as an “SOS code” or “Seed.” This step will be familiar to anyone who has used cryptocurrency before, as storing their seed phrases is a standard practice. Seeds usually consist of a set of random words that gives users direct access to their wallets on the blockchain, should they need to recover or change their wallets.

Instead of explaining the 12-word seed phrase as a technical feature of the blockchain, the explanation CitiCash offers makes it sound like a simple security feature, similar to how a bank would ask for your mother’s maiden name or similar security questions. It’s one of the many approaches they take to make this seem less like a new, intimidating world of cryptocurrency technology, and just another form of the safe and familiar banking that people have done for ages.

Their seed code is 26 words, which is a little longer than what many other blockchains use. Bitcoin’s standard for seeds is 12, and some wallets will look for 18 or 24.

Fortunately, CitiCash gives you the option to just copy and paste it somewhere where you can store it securely, whereas other wallets often have systems in place to walk you through repeating the phrase to ensure you’ve saved it somewhere.

With 26 words, that could get tedious, but CitiCash trusts you enough to let you tick a box to assure them you’ve saved your phrase, and you’re off to using the wallet.

First Use

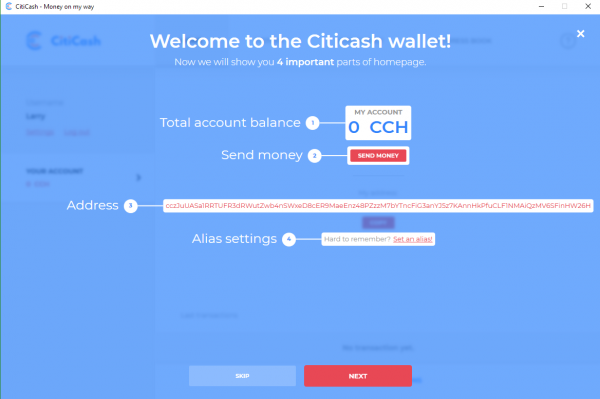

Once past the initial installation, you’re greeted with a walkthrough to introduce you to the interface. Most of the interface will be understandable to people familiar with cryptocurrency, but for those who know less, they have large, clear labels that name each section for you, and with each click of the big red “Next” button, they give you a short explanation of what each section means.

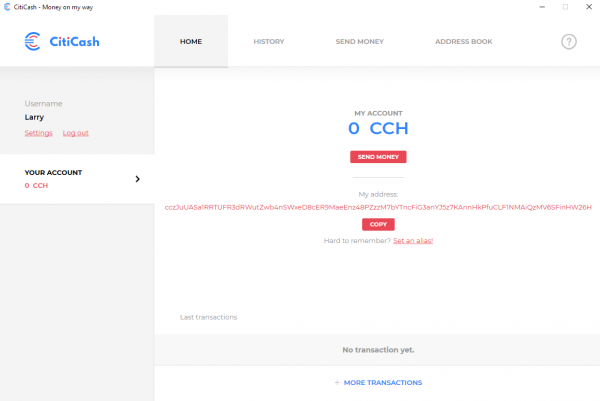

The walk-through completed, you’re finally off and running with the interface. They’ve gone for a clean design with lots of white space to convey simplicity. The primary reds and blues as color accents, and light gray text are all reminiscent of a bank, designed to convey reliability and familiarity.

They have really stripped everything down to the absolute bare essentials, with the home screen showing your current balance of CCH, the CitiCash currency, your address for receiving CCH, and below that a list of recent transactions. It’s so straightforward, it does make one wonder how it is that many other wallets seem to complicate the matter with additional information.

Exploring the Interface

Under your Username, there are only 2 options: “Settings” and “Log Out.” Under “Settings,” there isn’t much to do, as your username and password seem to be unchangeable. The only 2 things you can act on are to change your interface language, or take a look at your “SOS Key (Seed).”

Along the top of the interface is a menu with “Home,” “History,” “Send Monday,” and “Address Book.” Home is where you started. History shows a list of the payments you’ve made or received, and the only actionable item is a dropdown that lets you sort the list in various ways, such as displaying transactions from just the last 30 days, or showing only the outgoing payments, and so on.

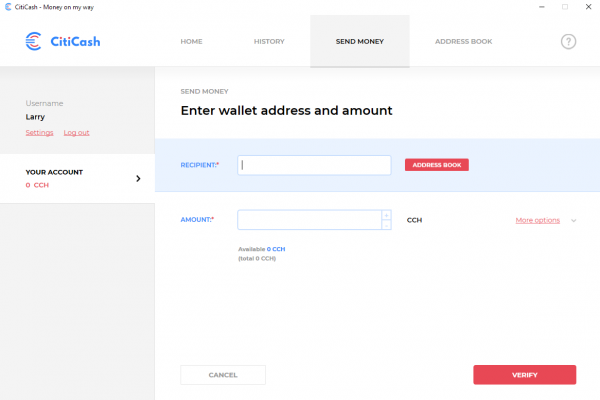

The “Send Money” function is very straightforward. You put in the CCH address of the person you want to send to, and the amount, and click “Verify” to make it happen. There is an address book, where you’re able to call up addresses of known recipients.

And here is a good place to mention that CitiCash gives you the option of attaching aliases to addresses, so instead of finding people by random strings of alphanumeric code, you can sensibly find them by the names you’ve given them.

A name and an amount is probably all you need to send, but there is a “More Options” link that reveals additional settings for a transfer. One is speed, where you can tick a box that allows you to make a faster transfer. You can set a custom payment ID which you might want to do for your own record keeping.

Lastly, there’s a slider marked “Security” where you can select a privacy level on a scale ranging from 6 to 240. CitiCash uses a system of mixing called “Ring Confidential Transactions,” or RingCT, which mixes your transactions in with other transactions to make them harder for any third parties to know who sent how much money to whom.

The numbers in the slider refer to the number of other transactions yours will be mixed with. The minimum (6) is almost certainly good enough for anyone, but mixing with 240 other transactions will create privacy that will be impossible to crack for all practical purposes. However, more security means higher transaction fees.

Under the “Address Book” tab, there is the list of people you have transacted with, and the names you have assigned to them. Each address has only those 2 pieces of information, and you can edit them both, or delete the contacts, as you desire.

Overall Thoughts

The CitiCash wallet does what it sets out to do, which is create a straightforward, simple interface that doesn’t confuse anyone with additional features that could otherwise be a barrier to understanding.

It would be too much to ask of any wallet to allow for someone to begin using it without any explanation at all. In particular, the whole concept of using an address to send money is so fundamental to most cryptocurrency users, that they forget that people new to crypto will tend to confuse it with email addresses or bank account numbers.

But the CitiCash wallet doesn’t have to exist as a tutorial on how to use cryptocurrency. All it needs to achieve is to be the simplest possible implementation, so that anyone who has heard of cryptocurrency, and has been told what an address is and how to use it, will find it easy to apply what they’ve learned.

The CitiCash wallet succeeds at achieving its aims of being a the simplest possible wallet interface one could ask for, and if the CCH token takes off, people will have no trouble using it.

What’s Next for CitiCash

CitiCash is still currently in development, though they’re hitting the milestones they’ve set out for themselves on their timeline. Currently they’re in a token presale, and they’re looking to be listed on exchanges within this year.

Their other wallets for Mac, mobile devices, and browsers should also be released soon.

It’s a big ambition to become a global currency, especially with other cryptocurrencies already having attained it. However, user experience is critical, and many other cryptocurrencies fail to deliver on those grounds, giving CitiCash an opening.

To find out more, follow CitiCash developments on Twitter, Reddit, or Telegram. On their website, you can see their roadmap, and read their whitepaper.

Their pre-release token sale is currently ongoing, and you can purchase tokens here.