Recently established US-based tokenized real estate fund, BlockEstate, has partnered with Polymath and CoinList’s ComplyAPI to raise US$50 million from accredited investors.

BlockEstate believes their competitive advantage in the real estate fund market comes from combining an aggressive real estate portfolio with the liquidity, security, and power of blockchain technology.

According to BlockEstate, they “will use predictive analytics to manage and invest that capital in a carefully selected portfolio of market sectors with the goal of maximizing returns.”

BlockEstate Will Put Real Estate on the Blockchain

BlockEstate’s business plan is to sell “security tokens” that represent fractional ownership of their future real estate portfolio fund.

Traditionally, investing in real estate requires incredible amounts of capital and defined, long-term horizons. Tokenizing real estate offers many benefits to traditional investments.

By tokenizing “shares” of a real estate fund, more investors can participate with less capital and have the option to enter/exit positions whenever they want.

How Investors See a Return From BlockEstate: Buyback and Burn Model

After raising money through a “Security Token Offering” (an ICO for security tokens), the team will go out and build a real estate portfolio.

BlockEstate will then use “on average, 50–100% of quarterly net profits” to buy back and burn tokens. In other words, they will repurchase tokens on the open market and permanently remove them from circulation. Decreasing the total supply of tokens theoretically increases the value of the remaining tokens held by investors.

BlockEstate also plans to purchase some new revenue-generating assets with quarterly profits. If you’re not sure how these decisions are made, ideally real estate funds like BlockEstate will build in some decentralized governance to enable token holders to “vote” on the fund’s future.

So far, it seems that the BlockEstate team will be holding the reins until some sort of governance system is put in place.

What Are the Benefits of Security Tokens?

From Anthony Pompliano’s Official Guide to Tokenized Securities:

Security Tokens are digital assets subject to federal security regulations. In layman terms, they are the intersection of digital assets (tokens) with traditional financial products — a new technology improving old things.

In other words: you use a digital token to represent ownership of something (stock, bond, debt, real estate, etc.)

The potential benefits of tokenizing traditional assets (security tokens) are many:

- 24/7 markets

- Fractional ownership

- Rapid settlement

- Reduction in direct costs

- Increased liquidity and market depth

- Automated compliance

- Asset interoperability

- Expansion of the design space for security contracts

This article explains the above benefits of security tokens in greater detail.

Downsides to Security Tokens

While security tokens offer some obvious advantages over traditional securities, they also come with some baggage.

Security tokens, representing ownership of real-world assets such as real estate, will inevitably require trusting a third party. This is not the case with digitally native tokens, such as Bitcoin.

For example: what if you purchase “ownership” of a car in the form of a security token. If someone steals “your” car, you no longer (in practical terms) have possession of that thing you “own” according to the blockchain. You will have to trust that the police and judiciary system in your local area will bring your car back to you in one piece.

Although trust is required with security tokens/asset-backed tokens, the benefits of increased liquidity, transparency, and accessibility are still a massive improve over the status quo.

Why Partner With Polymath?

BlockEstate choose to use Polymath’s Security Token Standard Protocol (ST-20), which makes launching their security token (BEAT) as simple as possible. Think ERC-20, but for security tokens.

Polymath also embeds all the legal and regulatory compliance into the protocol and allows for a streamlined token sale event.

Polymath is the leading platform in the “security token revolution” and they’ve made a ton of progress since inception.

According to Polymath CEO Trevor Koverko:

There will be more than $1 trillion of security tokens within the next five years, driven primarily by a massive influx of institutional capital.

Moving Forward and How To Participate

The BlockEstate token will be one of the first security tokens issued in real estate, representing fund-share ownership for token holders. Security tokens are gaining popularity, and being among the first projects to tokenize real estate investment will likely provide the team with “first mover advantage.”

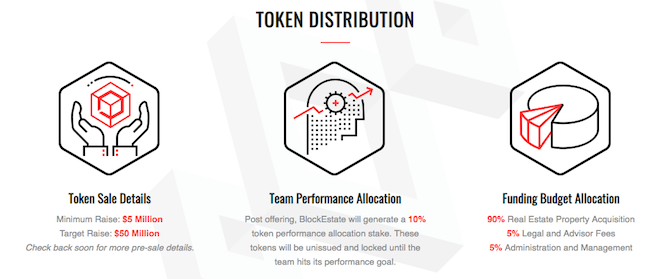

If you’re an accredited investor, you can apply to participate in the Seed round on the BlockEstate website.

BlockEstate also plans to list BEAT on the OpenFinance Network (OFN), a trading platform for tokenized securities. OFN works with institutional and retail investors on a global basis, deploying blockchain technology to facilitate more efficient trading of securities.