From the big league trading desks at Goldman Sachs to farmers in the fields of Nairobi, Kenya, alternative data (e.g., scientific data) has been quickly carving a place for itself across industries all over the world.

Despite some experts predicting that the alternative data industry will grow from 2016’s 200 billion-per-year in revenue to 400 billion-per-year by 2020, few people understand what alternative data is and the potential use cases for it. Furthermore, the alternative data industry is still lacking significant vehicles through which it can be freely traded and widely available.

What is Alternative Data?

First and foremost, alternative data should be known as a commodity that will enhance the way we understand the phenomenon happening in the world around us. Although the term “alternative data” will differ depending on whether you ask a financial expert or a techie, the general description is fairly straightforward.

Alternative data is non-traditional information that can be used in decision-making applications, such as investments, or in strategic business decisions. There are many more use cases beyond those two examples. Some sources say that there are as many as 24 different categories that alternative data can be classified into. Some of these categories include business insights and the internet of things (IoT).

Imagine the value of being able to better understand a changing weather pattern by measuring the location and intensity of sunshine across each summer for a specified number of years. Alternative data and associated technology have the potential to collect this non-traditional information, then use it to inform and feed self-learning machines. These self-learning machines can then process this data into more massive data sets to increase sample sizes, which, in theory, delivers more of a realistic portrayal of trends.

As briefly touched upon earlier, the alternative data industry as it currently exists is limited and lacking. In particular, there is not a marketplace on which scientific data can be freely traded and sold. Without an operational marketplace, data that is generated often goes unused.

Stagnate data can be useful to companies beyond the one that collects it—it can be used as a stream of revenue. Imagine the potential for a startup to collect scientific data from IoT-enabled devices and sell it as a way to generate revenue in early development phases. The industry as a whole is still a few steps away from that.

Before a wider adoption of alternative data can take place, alternative data must be more easily understood, and contemporary marketplaces for alternative data must be improved.

The Blockchain is the Next Evolutionary Phase for Alternative Data

Blockchains deliver a digital ledger platform on which cryptocurrencies and other applications can operate. Once loaded onto a public ledger, those events cannot ever be altered. Blockchain technology can usher a new wave of alternative data transactions. In the world of alternative data, blockchains can become an engine for the marketplace on which alternative data can be freely traded and sold.

While non-blockchain related enterprises such as Bloomberg and Kaggle offer a marketplace for scientific data, these platforms do not provide the same decentralized technology that will allow alternative data to be more freely traded. Additionally, the sale of scientific data off of the blockchain disconnects data from the immutable public ledger as well as from the smart contract enabled technology which alternative data marketplaces need.

Smart contracts can serve as the new frontier of scientific data transactions because of the pre-established, computer-enforced conditions that are typical of smart contracts. The transparent terms of a smart contract ensure that any data that is freely traded on a blockchain-enabled data marketplace will be used under the terms set out by the data collector.

Despite the capability of blockchain technology to produce the next-generation alternative data marketplace, the industry has yet to create a reasonable solution for a market on which alternative data can be freely traded and sold. However, there are projects in the works that are launching marketplaces as soon as this summer, such as SciDex.

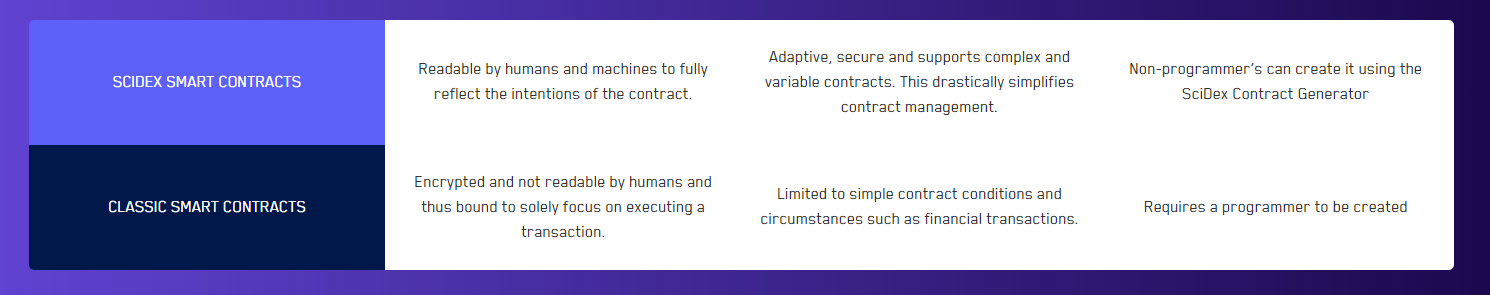

SciDex enables startups and fully-operational businesses to sell scientific data under specific conditions and terms through a compliance protocol that is known as the Ricardian Smart Contract (RASC). This mechanism allows smart contracts to be compliant and operation without the need for a physical component of the contract. Due to the physicality and interoperability of the RASC protocol, smart contracts can be read by both humans and machines while maintaining a high level of external compliance.

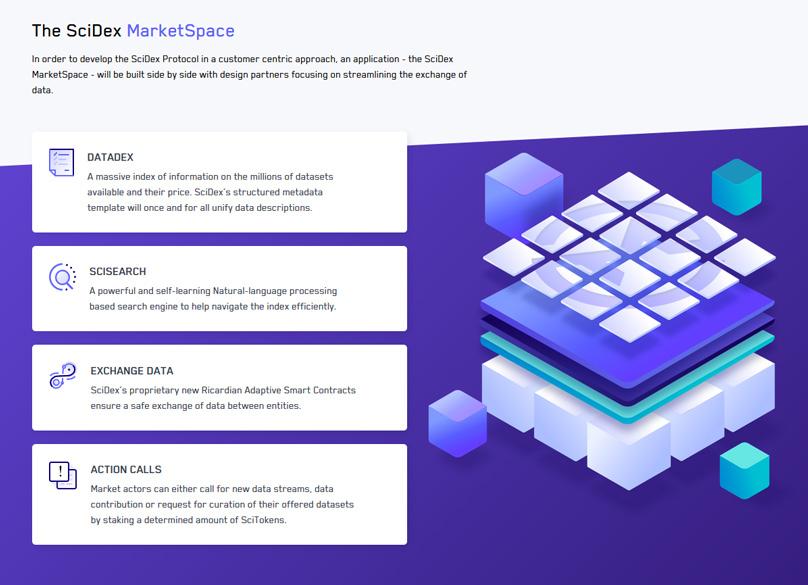

Since the terms and conditions of smart contracts are predefined, companies can specify exactly where and who the data will be sold to. For example, it would not be wise to allow your bot data to be purchased by your competitors, so you can specify the conditions to bypass that scenario. Instead, it would make more sense to sell scientific data to an NGO or non-profit that does not directly compete with your company. All of these features can be defined on SciDex’s MarketSpace.

Alternative data marketplaces like SciDex’s MarketSpace is the next evolutionary step in the progression of smart contracts and the sale of scientific data. This protocol empowers the next wave of startups and tech enterprises to sell data as a form of revenue. The RASC protocol will usher in a new era of compliance to ensure that smart contracts are performing as per the rules are defined. Smart contracts can then inform the conditions on which scientific data is freely traded and sold.

This allows blockchain technology to be used to its fullest potential, as the underlying vehicle for the free sale and trade of scientific data. Welcome to the future.