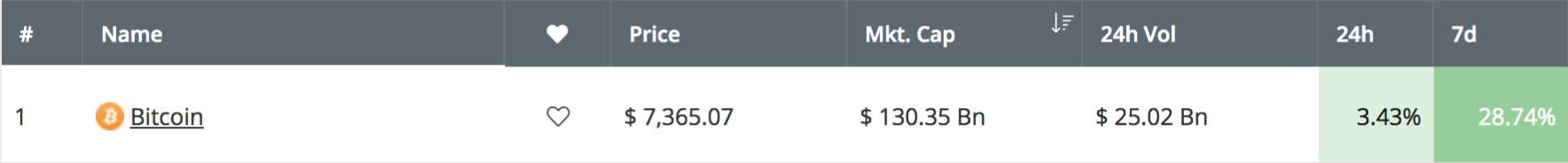

The Bitcoin rocket boosters continue to thrust upward after Bitcoin sees a 28% price increase over the past 7 trading days, bringing the current price for the coin up to around $7,394 at the time of writing.

Bitcoin’s recent price increase could most certainly be described as extremely parabolic after the cryptocurrency spent a mere 3 days within the $6,000 to $7,000 price range. The 100% price increase over the past 90 trading days alone shows how remarkable this recent surge really is.

Furthermore, the recent break above $6,250 can be considered to officially break the market out of the previous bear trend, which means that the market can no longer be considered a bearish market. This is because Bitcoin has risen by a total of 2x from its previous bottom price at around $3,125.

The King of Cryptos now holds a market cap value of $130 billion after managing to add a total of $35 million to its market cap thus far in May.

In this article, we will take a look at the possibility for Bitcoin to rise and reach the resistance at the $8,250 level. There is a combination of resistance at this area, and Bitcoin will need to rise by a total of 11% to reach it, as well as breaking above the $8,000 resistance level on the way up.

Bitcoin Price Analysis

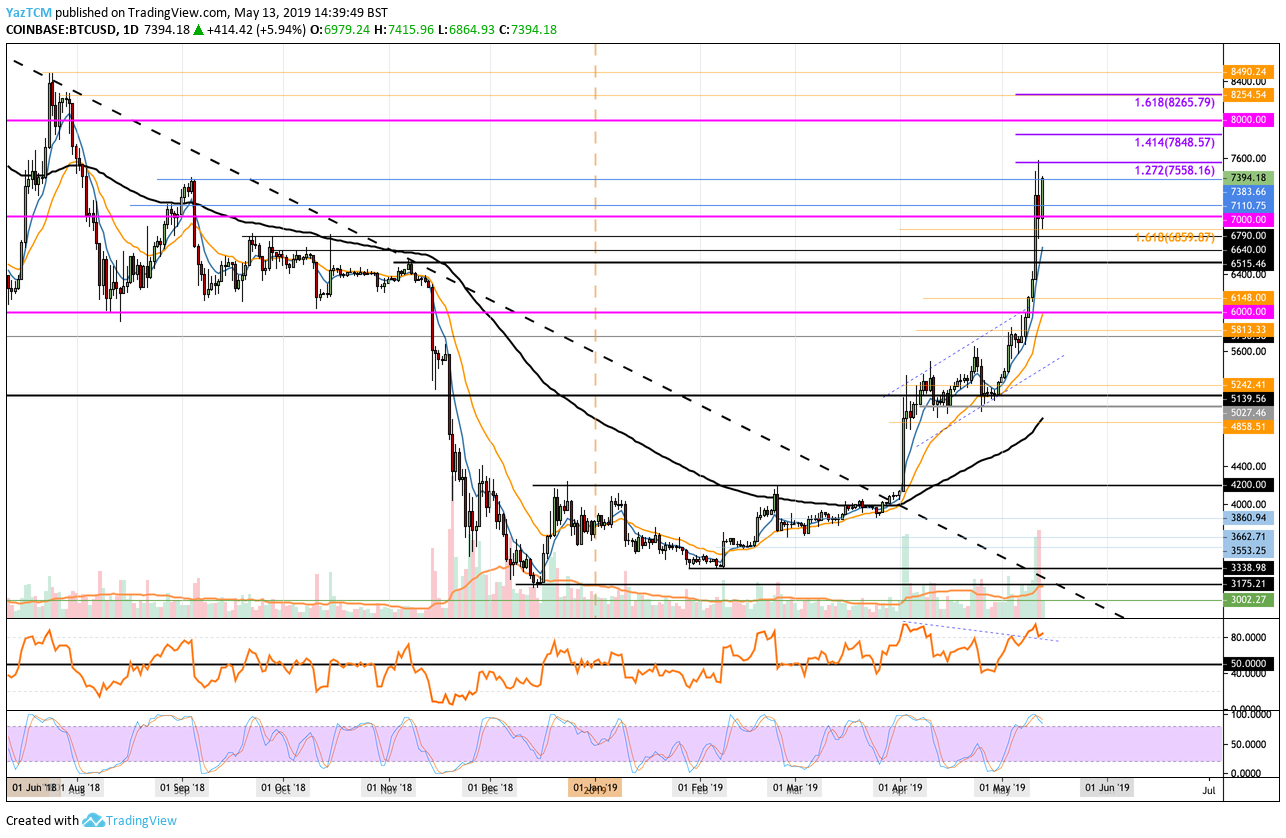

BTC/USD – LONG TERM – DAILY CHART

What Has Been Going On?

After briefly retreating yesterday, May 12, the bulls have driven BTC/USD to rebound higher once again. During the retracement, we can see that Bitcoin managed to find support at the $7,000 level but the market had even spiked toward a low of around $6,755.

Nevertheless, Bitcoin has rebounded by a total of around 4% today, and is currently trading at the resistance around the $7,390 region.

What Is the Current Short-Term Trend?

The current short-term trend remains bullish for Bitcoin at this moment in time. For this bullish trend to become invalidated, we would need to see Bitcoin fall sharply beneath the $6,200 region.

However, Bitcoin would not be considered bearish in the long term until a break beneath the $5,000 level.

Where Can We Go From Here?

If the bullish pressure continues and allows Bitcoin to break above the $7,400 level, we can expect immediate resistance above to be located at the short-term 1.272 and 1.414 Fibonacci Extension levels (drawn in purple), priced at $7,558 and $7,848. If the buyers can continue to break above these levels, the next level of significant resistance is then expected at the $8,000 resistance level.

If the bulls are successful in overcoming the resistance at the $8,000 level, immediate resistance above this is then located at the target $8,250 region. The resistance here is a combination provided by previous August 2018 resistance, along with resistance provided by the short-term 1.618 Fibonacci Extension level (drawn in purple), priced at $8,265.

If the buyers continued above $8,265, further resistance above is then located at $8,490.

What If the Sellers Resume Control?

Alternatively, if the sellers regroup and begin to push the market lower, we can expect immediate support beneath to be located at $7,110 and $7,000. If the sellers continue further below $7,000, more support is then expected at the $6,859, $6,640 and $6,515 levels.

Beneath $6,500, more support lies at $6,150 and $6,000.

What Are the Technical Indicators Showing?

The Stochastic RSI indicator is set up to provide a strong bearish signal downward. The Stochastic RSI indicator is currently trading within extreme overbought conditions and is primed for a crossover below signal which could see BTC/USD falling temporarily to give the bulls some time to recover from exhaustion. This is not surprising, considering that the market has been very parabolic over the past few days.

Furthermore, the RSI is also trading within extremely overbought conditions, which indicates that the buyers could be a little overextended and could result in a small pullback for BTC/USD, perhaps back to the $7,000 support level.

Conclusion

Bitcoin has seen very strong price growth over the past few days after breaking above the $6,000 and $7,000 resistance levels. Investors can be happy to know that, by definition, the Bitcoin market has now exited the previous bear market.

Bitcoin certainly has the potential to reach the $8,250 level within the next few weeks. However, before this will happen, the market may need to retrace slightly to give the buyers time to rest before they are able to regroup and push the market further higher.