Binary options trading is a once-popular trading method that, due to questionable broker ethics, has fallen into disrepute. Betex is a blockchain-powered binary options trading platform intent on bringing transparency to the practice.

Binary Options Trading

Binary options trading is a derivatives market (performance-based) option that is considered more exotic than vanilla options such as bond and employee stock options. With binary options trading, traders predict the direction of an asset’s price level, i.e. whether the price will go up or down and to what amount.

Let’s consider an asset like gold. Currently trading at US$1,258.10, a binary options trader could predict that gold will hit a strike price of US$1,300 by this time next week. The trader then buys a binary option token to this effect. Should this prediction come to fruition, the trader will have made a profit by receiving the original sum invested, plus a 70-85 percent return. If, however, gold does not reach the proposed value within the proposed time frame, the trader loses the entire investment sum.

Thus, binary options trading is an all-or-nothing trading method with a fixed risk and a fixed reward.

With a low barrier to entry (investment starts from as little as US$10), it is seen as a pocket-friendly option for many investors to gain a foothold in the investment world. Investors are, however, cautioned that for the most part, binary options trading is akin to gambling (as it is more risky than traditional investment options), and risks should be carefully considered from the outset.

According to Modest Money:

Binary Options trading isn’t a scam, but it’s financial gambling that will only work well in the long term for the most devoted and knowledgeable users.

Problems with Binary Options Trading

Binary options have been getting a bad reputation with many investors. This trading method has been notorious for luring in beginner investors who are taken by promises of big returns, while the risks are downplayed. Governments like Belgium and Israel have even stepped in to regulate the practice, going as far as proposing an all-out ban.

Brokers have historically downplayed risks, omitted or obfuscated terms and conditions, engaged in privacy breaches by cold calling using bought or stolen data, or refused to process withdrawals.

According to binary options database Fair Binary Options:

…very often the company would stop taking their calls, or send them an email saying ‘we suspect you of fraud’ and freeze all their funds. Because the customer didn’t know the real name or location of their salesperson, “they had nowhere to turn to get their money back.

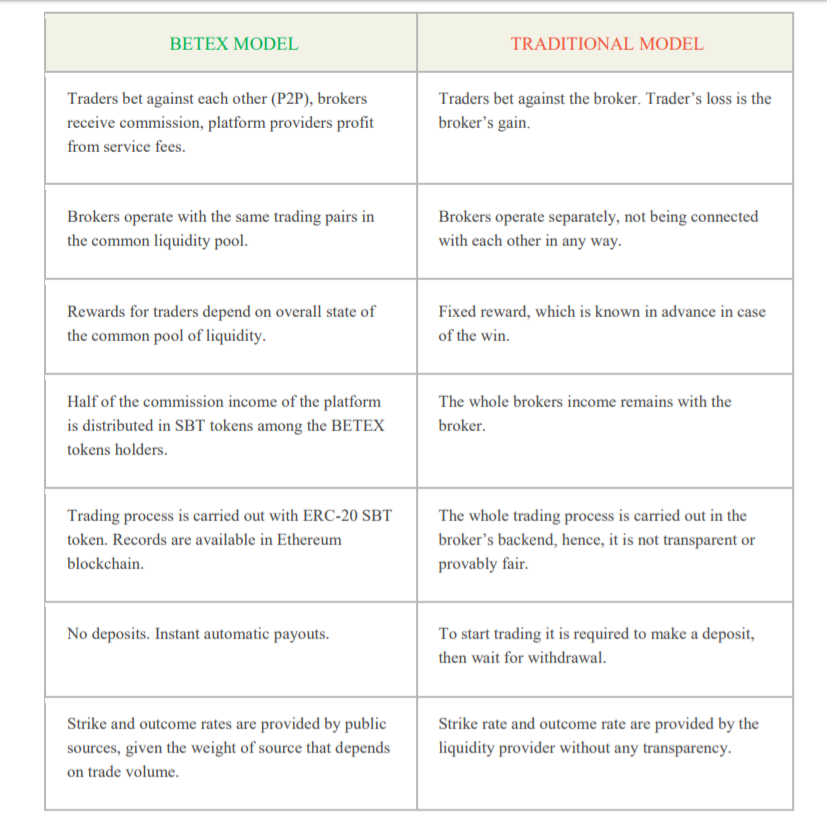

The problem has mostly stemmed from the fact that traders bet against brokers (giving brokers an incentive to position their clients’ losses against their own gains) and that trading occurs in a broker’s back-end — a lack of transparency that allows for easy manipulation of data. Overall, trust in a broker is, due to an inability to verify data, very hard to achieve or maintain.

The Betex Solution

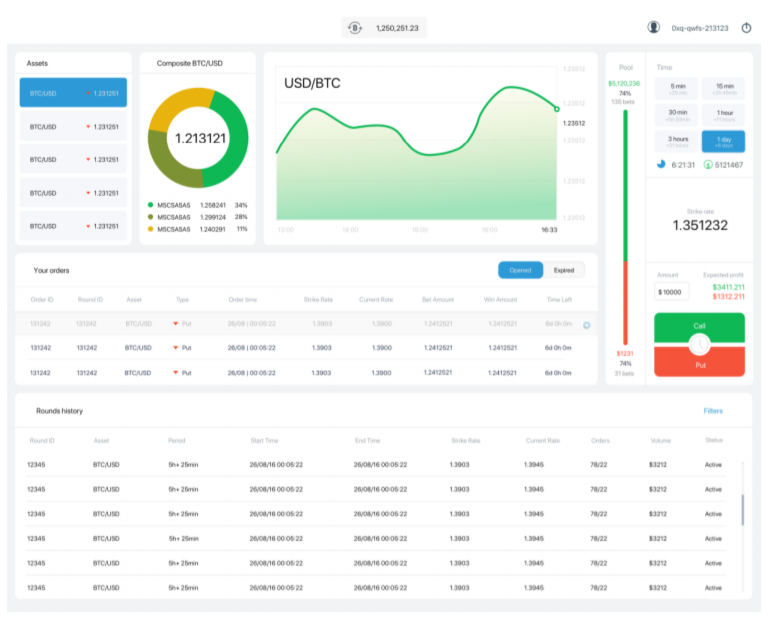

Betex is a peer-to-peer (P2P) blockchain-based binary options trading firm that makes use of Ethereum smart contracts. The company is intent on making a big change in the derivatives market through the introduction of a sound business process that is transparent and fair to traders.

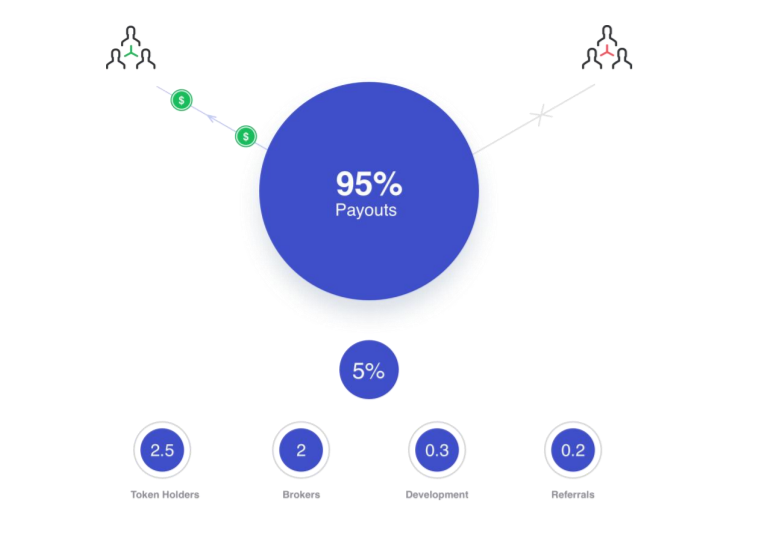

Instead of betting against brokers, their P2P model allows traders to bet against each other, resulting in payouts as big as 95 percent (the Betex platform has a 5 percent flat fee structure).

A common liquidity pool that is shared by all traders allows for a brokerage system on the Betex platform that does not involve other systems to which only brokers have access. This ensures that trading on Betex will always be open, fair, and audit-friendly. Brokers will be able to integrate into the platform, thanks to a white label solution.

Two MVPs (Minimal Viable Products) have been launched on testnet and can be tested at https://Betex.io and https://GoBet.io.

According to CEO Oleg Torkhov:

Our mission is to bring unprecedented transparency to the derivatives’ market, as well as develop the new derivatives, which won’t leave any chances for the old shady trading instruments to exist. All transactions will be publicly available for any checks. No one, including the platform, will be able to influence the process.

Refer to the table below for a comparative overview of Betex and traditional binary options trading systems.

The Betex ICO

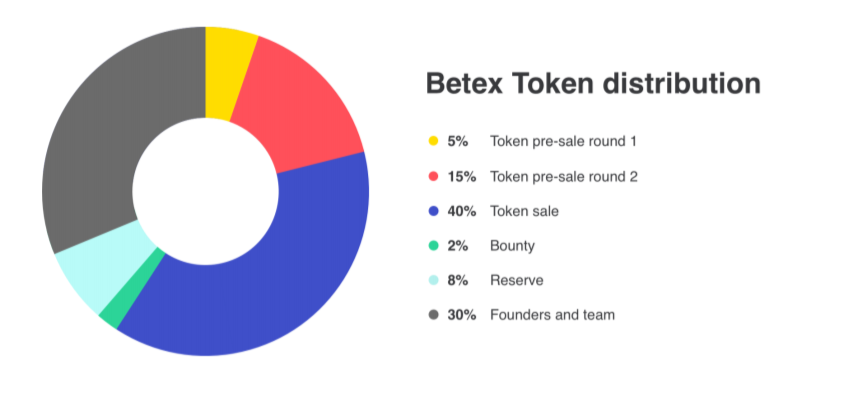

The Betex ecosystem sports two tokens: BETEX and SBT. BETEX is the platform’s main token that, as a security, will be registered with the SEC and other regulating authorities 15 days after initial distribution of its 10 million tokens (planned for Q2 2018).

The SBT, or Stable Betting Token, is the system’s operational coin. Its value is stable at US$1, and the token is used to place bets, receive payouts, and for platform development. SBT tokens are automatically generated, thanks to each transaction’s smart contract.

The first round of the company’s token pre-sale is currently live from December 4, 2017 to January 8, 2018. The next round will run from January 10 to 31, 2018, with the token sale to follow later in 2018.

In accordance with the SAFT (Simple Agreement for Future Tokens) agreement, token distribution will take place during the main round in 2018 once generation and registration have taken place. Only investors who have passed the KYC and AML procedures will be able to participate in the preliminary investing rounds.

Read the Betex whitepaper for an in-depth look at this unique business model. Visit the Betex website for more information. You can also follow them on Twitter.