We’re now well into 2019 and Bitcoin (BTC) has matured into a viable digital asset class, and is thus being widely traded in new markets by institutional investors. For instance, in addition to spot trading physical Bitcoin, the #1 cryptocurrency asset is now being heavily traded on derivative exchanges.

According to a report from Diar, Bitcoin trading volumes reached record-breaking levels on derivatives exchanges from institutional investors, indicating a new trend for 2019.

Record-Breaking BTC Derivatives Trading Volume

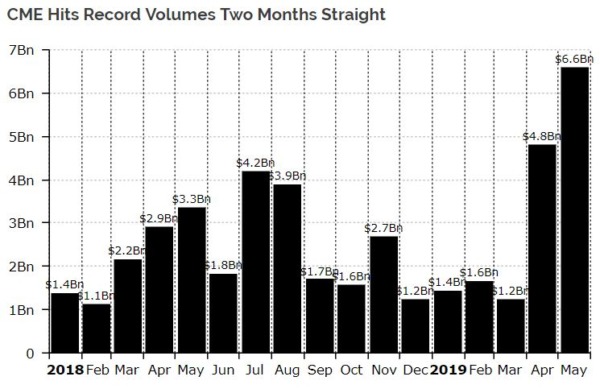

CME, the Chicago-based derivatives, option, and futures exchange with the only regulated Bitcoin futures trading venue, reached an all-time high in trading volume two months in a row. For the month of May, it has already reached nearly $7 billion in trading volume.

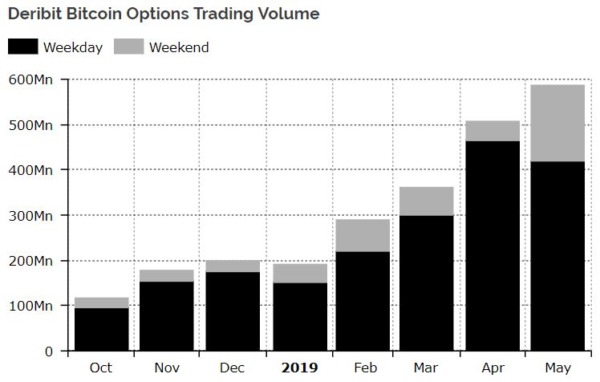

Additionally, Derbit, a Dutch-based derivatives trading platform that primarily focuses on European style options with the addition of Bitcoin futures contracts, has also reached record trade volumes month after month.

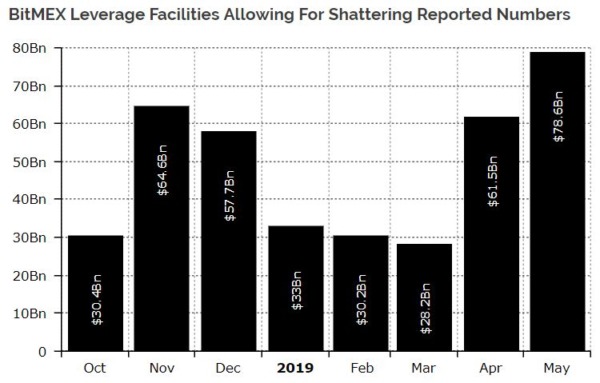

Another example comes from the popular Bitcoin margin trading platform BitMEX, which allows its users to trade with leverage of up to 100:1. As seen in the chart below, BitMEX shattered previous volume records as it recorded $7.8 billion thus far in the month of May.

Final Thoughts

Bitcoin is often touted as being digital gold and appears to be following in physical gold’s footsteps, where cash-settled derivatives trading far outweighs that of trading actual gold.

Bitcoin derivatives trading volume is poised to be far greater than volumes for Bitcoin’s actual and maximum supply of 21 million at this rate.

Moreover, Timothee Noat, the COO of Skew, a derivative-focused data-analytics firm told Diar that increased Bitcoin derivatives trading actually helps to reduce manipulation in the market.

Explaining, he said:

“The recent development of physically-settled futures adds to the development of the financial infrastructure that helps reduce market manipulation.”

Do you think Bitcoin derivatives trading will surpass volumes of physically traded Bitcoin? Let us know what you think in the comment section below.