How to profit from the crypto hype? That’s what a lot malicious entrepreneurs have been thinking the last year.

A quick look at Coinmarketcap shows a list over 1,100 cryptocurrencies. Most of these won’t be around in a few years, but this isn’t the problem. Most start-ups created today won’t be around in a few years either.

The problem is that a large number of these cryptocurrencies have been created with the sole purpose of making money from the blockchain enthusiasm. Once this is achieved, the project will be abandoned and the investors left empty-handed.

Unfortunately, greed drives a portion of investors who bypass their due diligence in their search for the next crypto to go to the moon. And they’ll buy anything that promises it will do so.

There are definitely cryptocurrencies out there that can skyrocket because they’re innovative and solid projects, but there are many more that are fraudulent or destined to fail.

This article identifies 7 signs of bad crypto practices that can help you separate the good from the bad and the ugly.

1. A Hidden or Silent Team

Do research on the team behind a cryptocurrency as this will make or break its success.

The first thing you need to do is assess the transparency of the team. Are they on the company’s website and are their full names displayed? If not, this is an indication that they may have something to hide as they seemingly don’t want to be linked to the company. No names or full names linked to the company is a major red flag.

Secondly, communication from the team is important. If they actively engage with their community, give updates and answer questions, they’re on the right track. However, if they seem to ignore their community or provide very little information about the progress of their project, there might be a problem.

Thirdly, the size of the team is a good indicator of future progress. If a company wants to change the world with their blockchain application, one or two developers probably won’t change much. Most big companies start with small teams, but over time they grow organically.

With all the hype around blockchain, a coin can get valued in the millions overnight and a team of three won’t be able to deal with the technical consequences of this. Moreover, there are a lot of highly staffed, major blockchain projects in the works and small teams will simply not be able to compete with them.

2. MLM Coins

MLM, or multi-level marketing, is widely-known and is often considered a Ponzi scheme. What MLM companies do is create a pyramid structure with the company at the top layer. New members are lured in by easy money in the form of referral bonuses and all they have to do is deposit a small amount of money, in this case cryptocurrency.

These members get returns on their initial deposit (value that comes from other members’ initial deposits), become enthusiastic, start spreading the word and deposit more. This continues until the company that created the pyramid is exposed for what it really is or when the exponential referral growth, where one person recruits two others, comes to a halt.

Onecoin, which has been discredited as a scam coin, is the perfect example of this. However, there are still plenty of other coins doing exactly the same thing; they just sell their MLM structure more creatively.

3. Pump ‘n Dump Coins

If you’ve seen the movie “The Wolf of Wall Street”, you probably already know the general idea of a pump ‘n dump.

Shady businessmen verbally transform sand to diamonds and everybody wants in. As soon as the hype seems to stagnate, the big holders sell, people start looking into the intrinsic value of the underlying asset and realise they’ve bought something worthless.

People have lost and are losing a lot of money because of pump ‘n dumped cryptocurrencies. Yes, most of these people have their greed and ignorance to blame; however, with this shiny new technology it’s quite easy to get caught in the hype.

Throw in some buzz phrases like “privacy focused”, “almost no to zero transaction fees”, “fastest transaction speed of them all”, “the king of Saudi Arabia is buying it”, and there you go. People race to buy the coin, and next thing they know, they’ve bought a useless coin.

With cryptocurrencies, social media plays a big part in these pump ‘n dumps. Take Chaincoin. Youtuber Highoncoins, who has quite a large following, made several videos about Chaincoin which started a pump.

He already bought his Chaincoins before these videos and thanks to his compelling arguments, his subscribers followed. This led to a massive spike, followed by a massive drop.

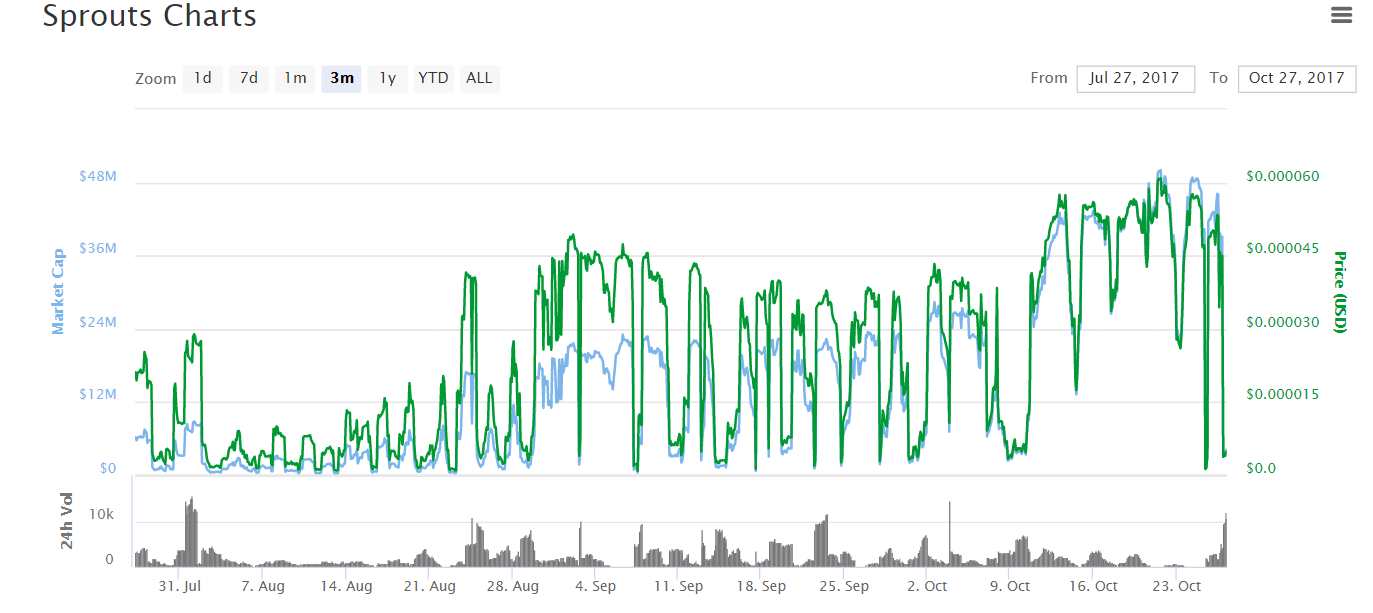

An important indicator of pump and dumps is the consistency of the volume. If a coin hasn’t been traded much at all over the period before the rise, you’re most likely looking at a coin being pumped. This indicates a lack of general interest and a community behind the coin. Sprouts is a popular coin currently being pumped and dumped. Just look at the price action and the 24h volume accompanying this.

4. It’s All in the White Paper

The whitepaper presented by a crypto-issuing company has to be sound. This is their business proposition as well as a presentation of their blockchain technology.

Can’t find a white paper? Thoroughly investigate why this is and whether the team will still publish it. The absence of a white paper is a bad sign, especially if you spot other signs that make you question the validity of the business and there’s no justification for it.

Another takeaway from the white paper is the use of language. If they didn’t make the effort to filter out grammatical errors in the constitution of their highly disruptive blockchain application, it’s unlikely they will pursue their misspelled aspirations.

The technology of a proposed blockchain is another important aspect of the white paper you should research. As these are quite complex (to say the least!) and you’re probably not familiar with all the tech, look for discussions about it on social media platforms such as Reddit and Steemit.

Also, look for the proposed roadmap of the company. Is it realistic and feasible? If the roadmap promises to deliver too much in too little time, it’s likely that you’re reading the whitepaper of a crypto that won’t be around in a year.

5. Moon Promises

Speaking of promises, too many of these are red flags as well. Guaranteed returns don’t exist when investing, especially in the crypto space, and no company can ever say with certainty that you will double your investment within a month. These are obvious traps set for greedy investors and are clear signs of shady entrepreneurs who are after your money.

Another promise that signals scammy practices is a claim stating that you can’t lose your money because the cryptocurrency is backed by another asset. The truth is, when you buy a coin, you’re investing in the technology of a cryptocurrency and its blockchain.

That they need to give you a safeguard indicates that they’re not even convinced of the success of their project themselves. Most likely, they want their investors to invest more capital based on a false sense of security. If you want to invest in gold, buy gold.

6. Pre-mined Coins

While about 65% of all cryptocurrencies in the market are pre-mined to some extent, this is always something you should look into. You cannot assume that a coin is a scam just because it’s pre-mined. However, always research the reason why.

The problem with pre-mining is that in some cases this gives the team behind a cryptocurrency an unreasonable amount of their own cryptocurrencies. They can easily dump all these coins when the price is at a level of their liking, cash out and buy a Lambo.

With pre-mining, a coin becomes highly centralised, and as an investor you’ll have to trust the development team. This could be quite problematic in the unregulated crypto space. Always look for an explanation why a coin is (significantly) pre-mined.

7. Other Red Flags

It may seem harsh to reject a crypto project based on minor flaws like grammatical errors on the website, but you have to do this. You’re investing in a Wild Wild West industry, and you need every sign of professionalism you can find. A lack of care in language could signal a lack of care in other parts of their project; what if they make a few minor errors in the programming of their blockchain?

When a blockchain is centralised, you know there is a problem. The true value of blockchain technology lies within its decentralisation which makes data on the blockchain tamper-proof. A centralised blockchain can give the illusion of this, but who knows what’s happening behind closed doors.

Also, assess whether a cryptocurrency has its own unique wallet. If not, find out why.

Finally, you should always check on which exchanges you can buy a crypto. If you can only buy them on one unknown exchange, you should probably not get involved.

Additionally, how many cryptos are there on the market and is this a finite supply? If most of the cryptos are still in the hands of the owners, they have to be able to fully justify this. If the cryptocurrency isn’t finite and can be created out of thin air, the price has no real meaning, and with currencies like that we would be back to square (dollar) one.

Found this article useful? Share with your friends to help them avoid scammy crypto investments!