Augur ($REP) is a decentralized prediction market built on top of the Ethereum blockchain.

Prediction markets have been around for a long time. What makes Augur different from existing prediction markets is that it is a decentralized platform. That gives it several advantages over centralized prediction markets, which will be discussed later on in this article.

As of November 2017, Augur has the 31st largest market cap of all cryptocurrencies, with a total value of $217 million.

What is a Prediction Market?

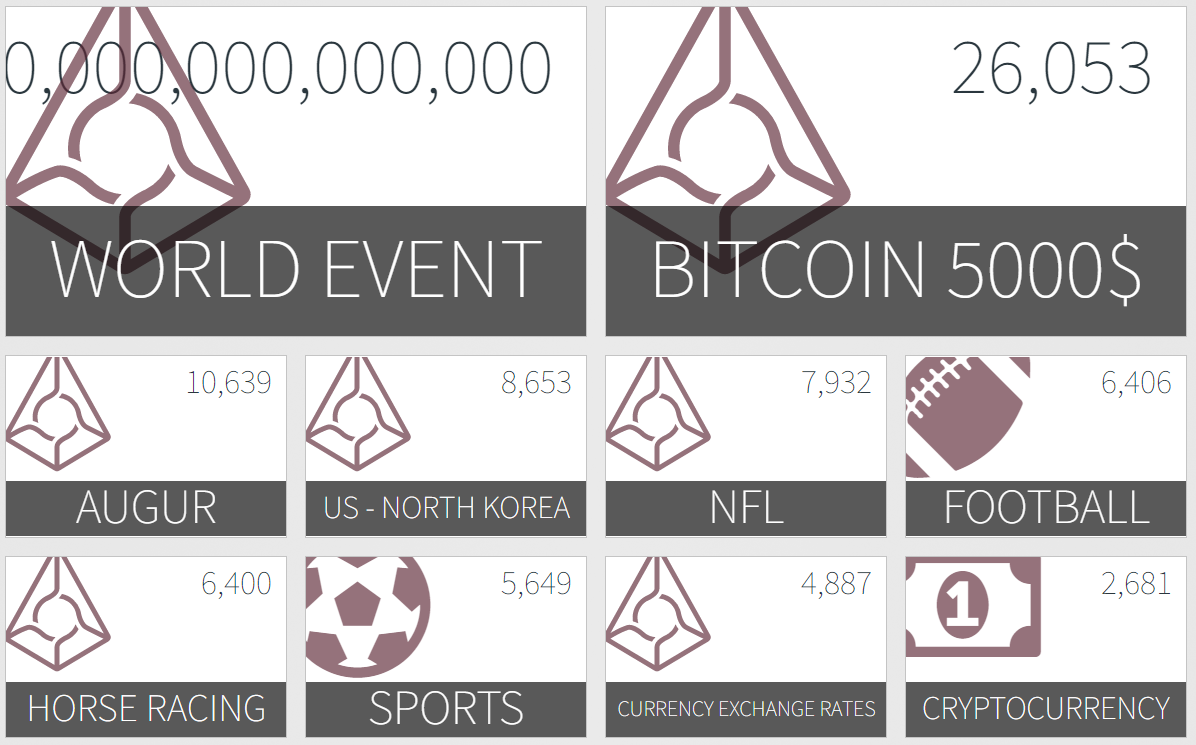

Essentially, a prediction market is a tool for forecasting the outcomes of future events. Prediction markets allow people to trade based on their expectation of how a real-world event will play out, such as who will win the next Presidential election, the next World Cup, or just about any other event you can think of.

The odds of any given outcome occurring are represented in real time by the share price of that outcome.

So let’s say that there is a question as to whether or not the price of Bitcoin will reach $10,000 by January 1st, 2018. If the odds of that occurring are 40%, then buying a single share in that outcome would cost 40 cents. In the event that Bitcoin does reach $10,000 by that date, the share buyer would receive $1 for every 40-cent share that they bought. And in the event that they are wrong, their shares would become worthless.

History of Augur

The idea for Augur was initially conceived in 2014 by co-founders Jack Peterson and Joey Krug. As described in their whitepaper, Peterson and Krug sought to create the first decentralized, open-source platform for prediction markets.

With an alpha version already released to the general public for testing, the Augur team held an online token crowdsale in September 2015 in order to fund further development. It was a big success and ultimately raised over $5.2 million — $2.5 million of which was raised in the first 3 days alone.

By March 2016, the first working version of Augur was deployed to the Ethereum testnet.

The Augur development team is still actively working on the software, and the release date has not been set.

If you wish to participate in the Augur beta, you can do so by signing up here.

What Does Augur Do?

Based on the ideas of game theory and wisdom of the crowd, prediction markets achieve greater forecasting accuracy than any individual experts can. However, the problem with previously existing prediction markets is that they were all centralized.

Centralization has a few drawbacks in this scenario:

- Centralized platforms have single points of failure, meaning that they can be shut down relatively easily compared to a decentralized system.

- Somebody has to report the actual outcome of the events that have been bet on. In centralized markets, this requires trusting an individual to report honestly and correctly every time.

By providing a decentralized solution, Augur allows people from anywhere in the world to ask a question about the outcome of a future event, as well as buy and sell shares on the outcome of any market they wish to participate in. Moreover, it allows thousands of users to report on outcomes, thus removing the need to trust in an individual reporter.

A critical part of the Augur platform is the token behind it, Reputation ($REP). However, most Augur users will never need to own Reputation or even know it exists. That’s because the main function of Reputation is to report on the outcomes of events, something that the majority of participants won’t do.

How Reputation works is pretty simple. In the month following an event’s conclusion, Reputation holders privately submit reports on the outcome. Then, in the following month, the outcome report is made publicly accessible in plain text for all to see. A consensus on the outcome is generated, and those reporters who were honest are rewarded with more Reputation. Meanwhile, any reporter who reports a false outcome loses Reputation.

All of the money that’s collected for a particular event is stored in a smart contract. When reporting on the event ends, the smart contract self-executes and redistributes the money appropriately based on the results.

By incentivizing reporters to be honest and accurate and storing capital for active events in smart contracts, Augur has created a truly trustless platform for prediction markets.

The Augur Team

Augur has assembled an experienced team of developers, led by co-founders Jack Peterson and Joey Krug.

Peterson is a former National Defense Science and Engineering Graduate Fellow and holds a Ph.D. from the University of California, San Francisco. Krug is one of the 2016 Thiel Fellows, which allowed him to take a leave of absence from Pomona College in order to work on Augur full-time.

Augur additionally has several notable advisors including the founder of Ethereum, Vitalik Buterin, trading expert Ron Bernstein, economist Dr. Robin Hanson, CEO of Enlighted Joe Costello, and Lightning Network founder Elizabeth Stark, to name a few.

A full overview of the team and their advisors can be found on the Augur website. If you want to connect with the team and a community of supporters, you can find them on their Discord.

Competitors and Challenges

The most obvious competitor to Augur is, without question, Gnosis (GNO). Like Augur, Gnosis is an Ethereum-based platform for prediction markets. However, Augur boasts a significantly higher market cap at $217 million compared to Gnosis, whose market cap is currently $74 million.

While Augur and Gnosis compete to do similar things, they are on the same team when it comes to mass adoption. Both teams are more concerned with competition from well-established, centralized betting platforms such as Betfair, Bookmaker, and Nadex.

As Gnosis founder, Martin Köppelmann, wrote in a 2016 blog post, “Most people don’t care whether something they use is decentralized or not. It must be decentralized AND cheaper AND more secure AND a better user experience AND more accessible.”

This succinctly captures Gnosis and Augur’s biggest challenge. While cryptocurrency and decentralization enthusiasts like you and me want to see this technology be successful, mass adoption isn’t likely to happen until there are tangible benefits to adoption for most people.

This is why Reputation is so important to Augur’s success. By having a mechanism that incentivizes honest reporting by coin holders, Augur is able to operate with significantly lower fees than a centralized betting platform. Lower costs can go a long way to help rapidly convert users from those major betting markets to the Augur platform.

Ultimately, Augur still has a long way to go if they are going to achieve what they set out to do. They will have to prove that the platform is secure and that their reporting mechanisms work. All of this will take time. But it is certainly possible from a technological standpoint, and Augur’s team appears poised and capable of pulling it off.

How to Purchase and Store REP

It’s possible to buy Reputation tokens on most major cryptocurrency exchanges, including Bittrex, Poloniex, Shapeshift, Kraken, and Gatecoin.

It’s not recommended that you leave the REP on the exchange after purchasing, though. As REP is Ethereum-based, most Ethereum software wallets will work for storing any REP that you wish to hold. These include popular wallets such as Jaxx, Mist, and MyEtherWallet.

Augur also recommends a specific hardware wallet, the Ledger Nano S, if you wish to put your REP in cold storage.

You can find more information about REP here.

Last Thoughts

Considering that Augur is still in the beta phase, there’s a lot of work yet to be done for it to be a successful project. With that being said, it’s reasonable to say that Augur has the potential to become the greatest online gambling platform in history.

With its talented development team and many notable advisors, Augur appears to be in a great position to capitalize on its potential and become the preeminent forecasting tool out there. But with strong competition from Gnosis — not to mention the resistance that centralized betting markets will certainly put up if they start losing tons of users — it’s anyone’s guess whether Augur will succeed.

We’ll just have to wait and see how it plays out.