In October, cryptocurrency had a wild ride with bitcoin’s ascension past the US$6,000 mark. We look at the key market and industry news that hit the headlines this month, and where some of the current blockchain trends are taking us.

World News and Trends

Asia

Taiwan Believes in Crypto

Taiwan’s national fintech focus has moved to include cryptocurrency, which it deems “a huge opportunity for growth.” In Taiwan Cryptocurrency Scene Mirrors Japan, we look at cryptocurrency’s positive status in the Southeast Asian country.

South Korea Considers Bitcoin Taxation

When cryptocurrency popularity keeps growing, governments notice… and react. Korea is sitting up and taking note of the taxation opportunities they’re missing out on thanks to the influx of domestic fiat currency into cryptocurrencies like bitcoin. Bitcoin Tax in South Korea? explores this new development.

Japan’s VISA-Backed Crypto Card

Japan’s budding relationship with cryptocurrency continues. UK-based bitcoin debit card & multi-currency wallet company, Wirex, is partnering up with Japanese firm SBI Holdings to further cryptocurrency adoption and blockchain development in Japan. Following on Wirex’s earlier virtual currency credit card, the new VISA-backed cryptocurrency payment card will enable customers to spend their Yen at any VISA-friendly merchant. SBI Holdings, meanwhile, has partnered with Ripple to create a blockchain-enabled remittance solution and has entered the crypto exchange space.

Omise Enters Japanese Credit Market

Thailand-based fintech company Omise has partnered with one of Japan’s most prominent financial services providers. We speculate about what this might mean for the company’s blockchain platform OmiseGO in Omise Partners with Credit Saison.

No Stopping China in the Cryptocurrency Market

If cryptocurrency is stateless, then China is its poster child. Even in the face of bans flying left, right and centre, there’s no stopping the Chinese. Instead, they simply manage to find ways and means around governmental restrictions, such as moving their operations to other countries or conducting private peer-to-peer fundraising instead of the usual open market ICO model.

China’s Government Cryptocurrency

After China’s ICO and cryptocurrency exchange bans, rumors started surfacing that China would move to develop a state-owned cryptocurrency. While there’s been no official announcement as yet, discussions have taken place about introducing a national cryptocurrency to aid stabilization of the nation’s fiat currency.

Singapore Won’t Regulate Crypto

The Monetary Authority of Singapore (MAS) is embracing the blockchain. The city-state is trial-testing a digital tokenized version of the Singapore dollar through Project Ubin. In terms of regulation, while ICOs are regulated if they fall under futures and securities, MAS’ managing director said in a recent interview that cryptocurrencies won’t be regulated. Instead, the central bank will focus on evaluating possible risks that might require a regulatory response.

Australia to Remove Double Taxation

The Australian Senate has moved to pass the Treasury Laws Amendment (2017 Measures No. 6) Bill 2017. The legislation was first introduced in September, and the reform is aimed at removing double taxation (i.e. taxed on purchase, then taxed on use) of digital currencies. The bill will become an Act of Parliament once it receives Royal Assent by Australia’s Governor-General.

Australian Push for National Currency

FinTech Australia, an industry advocacy group, and the state’s own FinTech Advisory Group have teamed up with three fintech startups (AgriDigital, FlashFX, and Othera) to open a discussion with the Reserve Bank of Australia regarding cryptocurrencies. These stakeholders are pushing for the creation of a government cryptocurrency, the ‘Digital Australian Dollar’, or DAD. The currency would be tied directly to Australia’s fiat currency, and strengthen the country’s fintech blockchain expertise.

IBM’s Cross-Border Payments

In the race between IBM and Microsoft over who will take the throne as blockchain industry leaders, IBM is making great strides. The technology giant’s latest move is cross-border payments using a system that incorporated both public and private blockchains. IBM is working in partnership with blockchain startup Stellar. So far, funds moved have been British pounds and Fijian dollars, but the purpose-built platform is designed to process seven South Pacific fiat currencies, including the Australian and New Zealand dollars.

Europe

International Monetary Fund Says Crypto Could Be the Future

The International Monetary Fund (IMF) is a big deal type organization. Founded in 1945, it’s US$668 billion strong. Through its existence, the fund brings together 189 countries to work on some of the biggest financial goals in the world, including international trade, exchange rate-stability, and sustainable economic growth. And its managing director, Christine Lagarde, is busy preparing for a future where cryptocurrency rules the day. During a recent Bank of England conference, Lagarde devoted a third of her talk on fintech by the year 2040 to the topic of crypto. She told attendees that consumers might come to prefer cryptocurrencies to fiat. She added, “Why might citizens hold virtual currencies rather than physical dollars, euros, or sterling? Because it may one day be easier and safer than obtaining paper bills, especially in remote regions. Virtual currencies could actually become more stable.”

Russia and the CryptoRuble

Russia has a lot of taxable revenue to lose if cryptocurrency trading goes mainstream, and a lot to gain if this happens and the proper regulations are in place. The state is opting to keep as a big a handle as possible on this new fintech industry. In Russia’s Very Own Cryptocurrency: The CryptoRuble, we take a closer look at what lead up to this decision.

Abkhazia’s Billion-Dollar ICO

The Autonomous Republic of Abkhazia is a mostly unrecognised breakaway state. The Republic shares borders with Russia and Georgia. Last month we reported that the unrecognised state of Transnistria plans on making cryptocurrency mining a national activity. Now Abkhazia, not to be outdone in the Eurasian Economic Community (EurAsEC), is planning on creating a state-backed cryptocurrency. The Abkhazian Republic Coins (ARC) would ultimately replace the current mixture of Russian rubles and Georgian hryvnia the country uses as legal tender. The intended ICO will raise a goal target of 1 billion dollars and is open to foreign investment.

Ukrainian Bills Consider Cryptocurrencies

The Ukrainian Blockchain Association, local trading platforms, and Ukrainian miners have drafted a bill on cryptocurrencies that has been submitted to Parliament. The bill focuses on the treatment of cryptocurrencies, with its goal the legalization of cryptocurrency transactions. (Original bill here.) A second bill was also submitted, proposing for cryptocurrencies to be recognized as financial assets, taxation to be simplified, and electricity tariffs for mining to be reduced. (Original bill here.)

Kazakhstan to Launch National Currency

Kazakhstan is hungry for a state-owned cryptocurrency of its own. The country’s Astana International Financial Center (AIFC) is partnering with Malta-based investment firm Exante to launch a national fiat-backed cryptocurrency built on the Stasis platform. AIFC is in partnership with Microsoft, Deloitte, and Waves in its efforts to become a regional blockchain hub. The financial body believes that the Digital Kazakhstan programme will be key to the country’s development.

Americas

Banking on Bitcoin – Wall Street’s First Crypto Trader?

Unlike rival firm JPMorgan, Goldman Sachs is more transparent about its opinions about cryptocurrency and the blockchain. Banking on Bitcoin: Wall Street’s First Crypto Trader? explores the financial giant’s investigation into adding cryptocurrencies as a trading option.

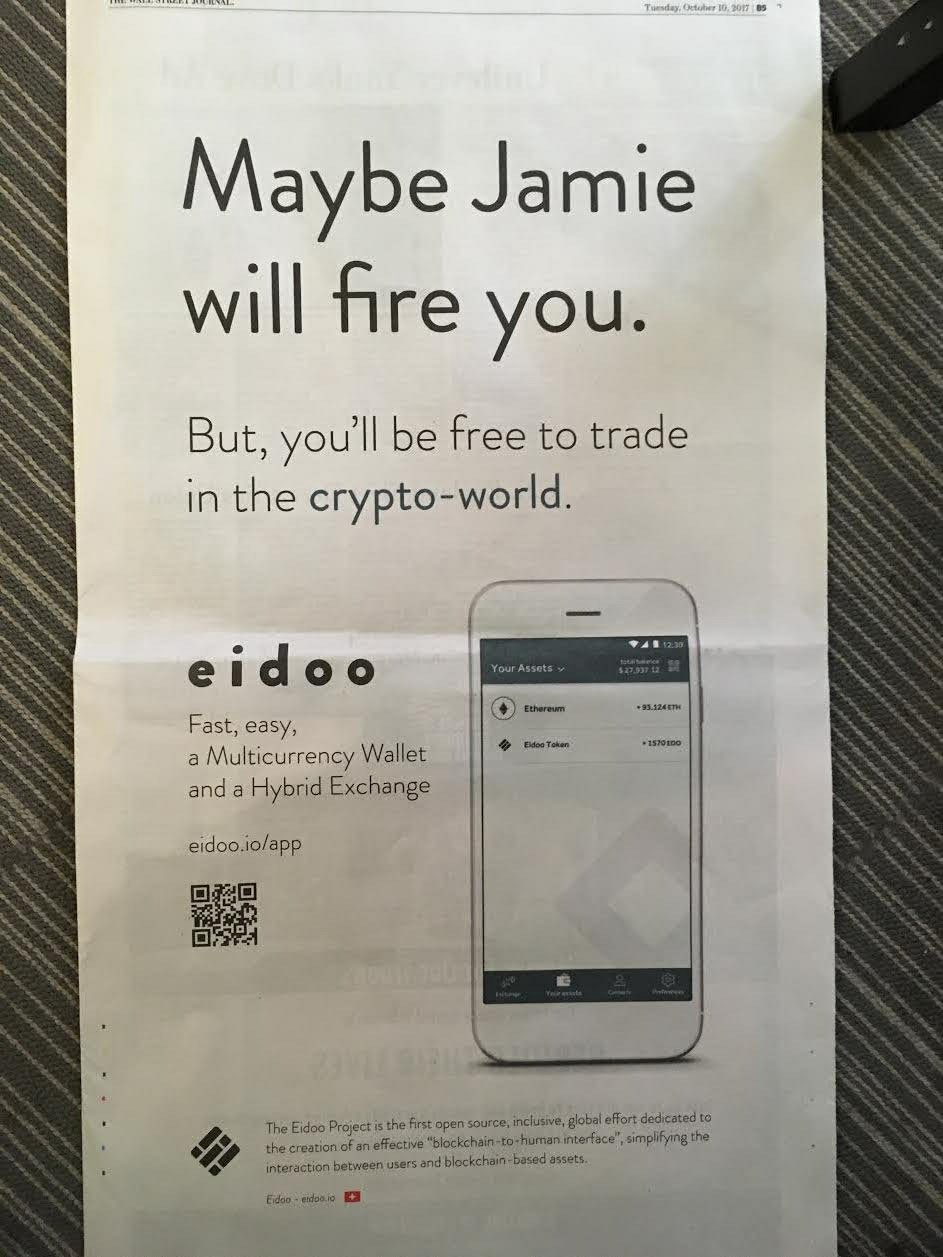

Wall Street Journal Ad Takes Stab at JPMorgan Over Bitcoin Views

Speaking of JPMorgan’s Mr Dimon. His controversial statement that he’d fire an employee for trading bitcoin gave Eidoo, a blockchain asset management company, plenty free publicity. The startup took out a full-page ad in the Wall Street Journal, poking fun at Dimon’s statement by saying, “Maybe Jamie will fire you. But, you’ll be free to trade in the crypto-world.” Although the ad itself must have cost a pretty penny (a full-page ad can go for as much as US$354,823), the resulting publicity was worth twenty times that, and the company’s app got over 20,000 downloads in the process.

Government Made Wikileaks a Bitcoin Profit

Bitcoin’s surging price this month saw Wikileaks founder Julian Assange express his thanks to the US government for the imposed 2010 banking blockade that necessitated the foundation turning to bitcoin as a donations gateway. In Wikileaks Thanks Government Over Bitcoin Boost, we track the nonprofit’s relationship with the founding cryptocurrency.

Former Federal Reserve Bank Chairman Speak Out on Crypto

Ben Bernanke is an American economist and the former Chairman of the Federal Reserve, the US central bank. He led the bank during the 2008 financial crisis. This month, he spoke at a Ripple event, saying that blockchain or “these electronic currencies” can improve an otherwise slow and expensive existing payment system. He added that bitcoin won’t succeed in replacing fiat currencies because governments wouldn’t allow it.

Billionaire Banks on Bitcoin

Mike Novogratz, CEO of Galaxy Investment Partners, is not just any billionaire. The former Fortress Investment Group principal and erstwhile Goldman Sachs employee famously said in 2013, “Put a little money in Bitcoin…Come back in a few years and it’s going to be worth a lot.” At the time, bitcoin was worth $200. Today, it’s circling $6,000. Novogratz has invested a substantial amount in bitcoin and ethereum, making a US$250 million profit in one go. He went out and got himself a Gulfstream G550 jet as a treat for his smart investment choice. Novogratz predicts that bitcoin will reach US$10,000 in the next 6 to 10 months. He is of the opinion that bitcoin is the “largest bubble of our lifetimes” but that you should own it anyway. In September, he responded to Jamie Dimon’s opinionated statement, backing bitcoin.

I normally agree with Jamie Dimon but he’s dead wrong on BTC. Blockchain has gone from experiment to implementation. It’s a revolution.

— Michael Novogratz (@novogratz) September 12, 2017

Middle East

Dubai to Launch State Currency

While countries around the world are debating or planning the launch of their own state-backed cryptocurrencies, Dubai isn’t one to wait. The Middle Eastern nation has launched emCash, the government’s blockchain-based crypto, with which residents can pay for anything from school fees to their morning coffee. This supplements Dubai’s plans to become a fintech hub and their push to become a blockchain-based economy. One can only wonder it the Dubai bitcoin property market will soon have to move over to the emCash property market.

Iran Looks into Crypto

Valiollah Seif, governor of the Central Bank of Iran has confirmed that the government is looking into cryptocurrencies. He added, “CBI views it as something that can be controlled and does not see it as multi-level marketing or a pyramid scheme.” This has sparked speculation that Iran could follow in the footsteps of other countries by creating its own national cryptocurrency in future.

Trends

Browser Cryptocurrency Mining: The End of Website Ads?

With a number of websites using a script to mine Monero via user’s computers, we look into the possibility of replacing website ads with cryptocurrency mining in Browser Cryptocurrency Mining: The End of Website Ads?

Crypto Hedge Funds Top 100

Reuters reports on data by fintech research house Autonomous NEXT that there are now 110 hedge funds that trade cryptocurrencies with a total asset value of US$2.2 billion. 55 of these were launched between August 29 and October 18.

Bitcoin in the Real World

While bitcoin is becoming more famous by the day as the fastest store-of-value climber of our generation, there are businesses and individuals the world over proving – or at least testing if – it can be used as an everyday currency exchange. We gather up the bitcoin troops in Bitcoin in the Real World: Is it Possible to Live on Bitcoin?

Bitcoin Races to the Top

During the #money2020 payments race, bitcoin outperformed traditional payment methods such cash, gold, and chip and pin. In Bitcoin Wins the #Money2020 Race, we speak to winner Amélie Arras who had, up to weeks before the race, had never heard of cryptocurrency, about the community factors that made her win, and why she’s since become a convert.

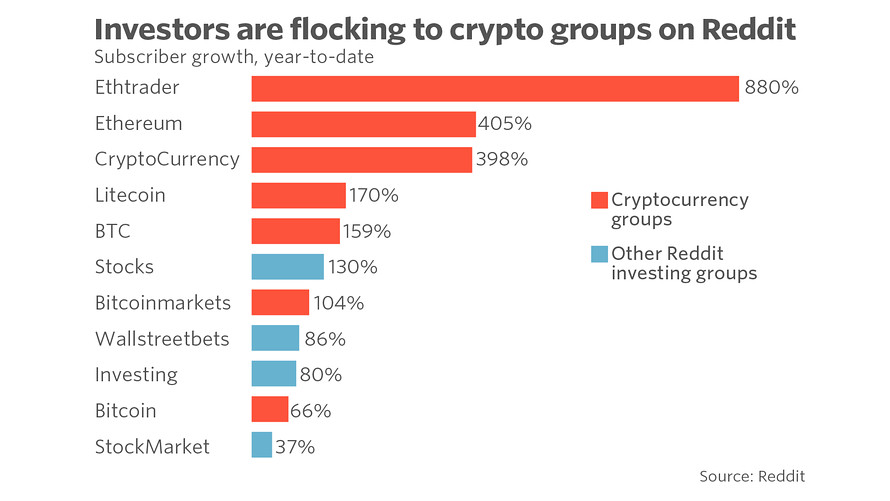

Crypto Explodes on Reddit

According to MarketWatch, data shows that cryptocurrency subreddits are going to the moon, with user numbers climbing a whopping 930% this year and as much as 1,300 new users a day.

Ethereum Founder on Central Banks and Crypto

Ethereum creator Vitalik Buterin says banks and governments are a long way off from creating their own viable blockchain-based cryptocurrencies, and that at the moment it’s nothing more than marketing and hype.

Crypto Market Prediction for 2023

Market research by leading research firm Orian Research indicates that the cryptocurrency market will be valued US$3.6 billion, with a compound annual growth rate (CAGR) of 48.3 percent.

Terminally Ill Man Becomes Bitcoin Millionaire

Cryptocoins News previously reported in May of this year on a Redditor said to be terminally ill. Having little left to lose, he took out an equity loan on his home to invest $325,239 in bitcoin. This bought him a total of 191.118 bitcoin. With the recent spike in price, the popular cryptocurrency news outlet went back and did the math. At the time, bitcoin has shot up to $5,736 per bitcoin, meaning that the Redditor’s investment had climbed to a total value of $1,096,258.58 worth of bitcoin. While it’s not clear whether he had kept the value in bitcoin, it’s an interesting backdrop against which to track the currency’s dramatic climb.

Bitcoin (BTC) Market Watch

September Pricing Index

October 1 kicked off at US$4,366.60 (US$4,904.90 on September 1). While September 2 boasted the highest price for the month (and in the history of bitcoin) of US$4,969.00, October 21 reached the month’s highest (and all-time-highest) number of US$6,190. While September 15 saw the month’s lowest at US$2,981, October 7 took a dip down to US$4,316.10. The month closed at US$6,458.30. September closed at US$4,367. (Source: Investing.com)

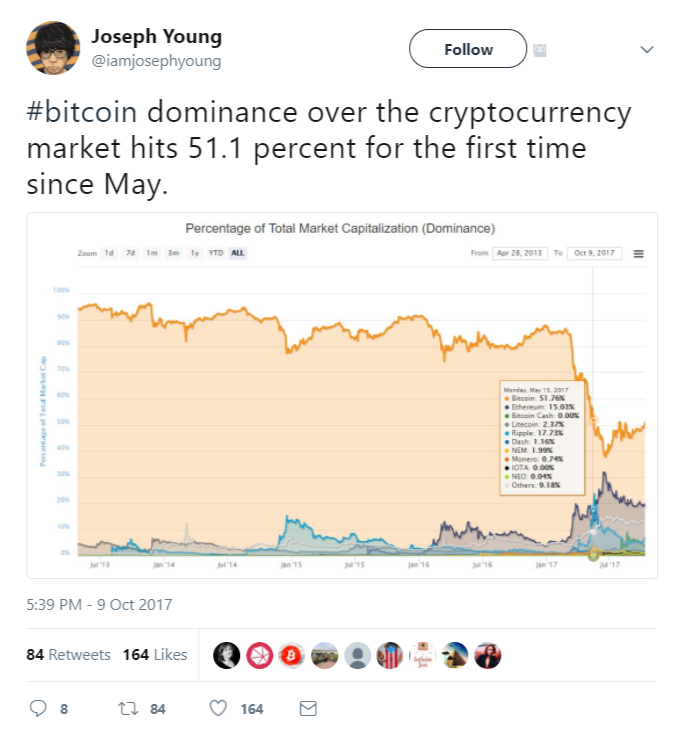

Bitcoin Dominates Crypto Market for First Time Since May

In early October, Bitcoin’s Dominance Index finally hit 51.1 percent for the first time since May of this year. Cryptocoins News looks at why it fell below 40 percent and possible reasons for its recovery.

Bitcoin Gold’s Blunders

Earlier this month, we reported in All That Glitters is Not (Bitcoin) Gold that there were more questions raised about the proposed bitcoin “fork” than there were reasons to trust and buy into the new split-off air-drop Bitcoin Gold. Once exchanges started crediting users’ accounts a few days ago, Bitcoin Gold saw a 62 percent drop in value on Day 1. The split currency has been the victim of a massive DDoS attack since.

Coinbase and Instant Bitcoin Buying

Investors were happy with the Coinbase announcement that bitcoin can henceforth be bought instantaneously. We look at why this is good news in Coinbase Just Made Buying Bitcoin Instantaneous.

Ethereum (ETH) Market Watch

September Pricing Index

Ethereum entered October at US$295.05 (as opposed to US$389.90 in September). While September’s high of US$394.78 was reached on the 1st of the month, October had to wait till the 16th for the currency to climb to the month’s highest point of US$353.01. The September 15 low of US$201.26 was followed by the October 23 low of US$274.07. October closed at US$304.24, while September ended at US$303.44. (Source: Investing.com)

Ethereum Successfully Implements Hard Fork

Despite certain concerns, which we detailed in Ethereum Forks Today, the Byzantium hard fork was a success. Ethereum reports that the second of three planned hard forks might come sooner than expected. However, the Ethereum price remains sluggish of late, which is what we’ve been seeing with all cryptocurrencies lately save for bitcoin.

Zcash Market News

Bithump Lists Zcash

Zcash has been listed by South Korean exchange Bithump, arguably one of the largest exchanges in the world right now. This follows after the currency was listed by English exchange CEX.io just a day prior.

Updates on Other Cryptocurrencies

Lisk

An auditor has thrown caution to the wind and invested all-in on Lisk thanks to two bank loans. Read his story at Accountant Invests All in Lisk.

District0x

District0x has released their second ‘district’, Name Bazaar. The decentralized blockchain peer-to-peer marketplace is ahead of its time and is a buy-and-sell space for eth. domain addresses purchased on the Ethereum Name Server. Read more about it at District0x Releases Name Bazaar.

Ark

As part of its roadmap fulfilments, open source tech startup Ark has released its new website. In Ark Gets a New Website, we take a look at this promising company.

ICO Trends and Market News

Trends

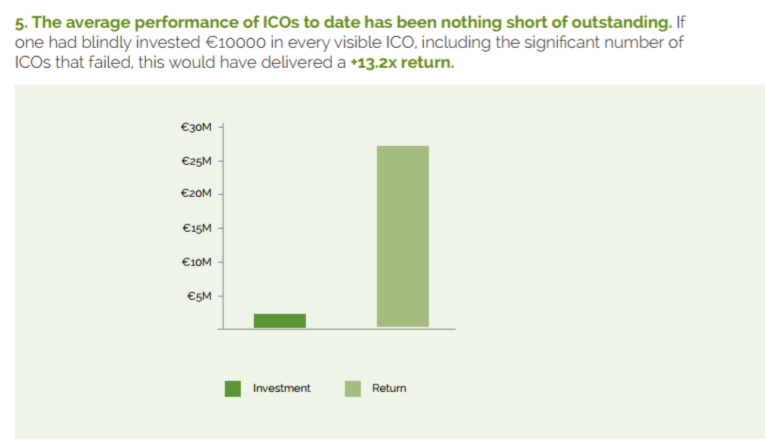

Average ICO Investment Return

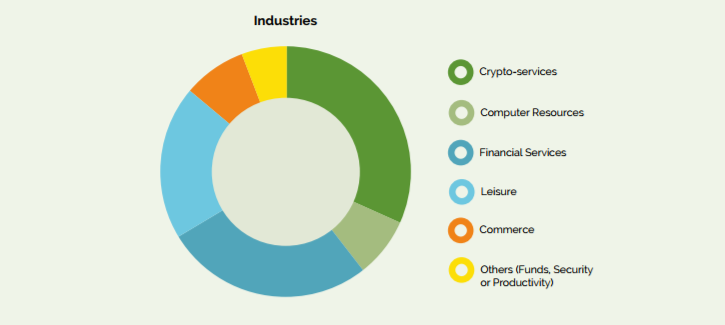

A new report by venture capital firm Mangrove Capital Partners helps explain the ICO craze. Simply put, it’s a good investment! According to the report, a blind investment in every ICO thus far with a known outcome (204 in total), including failed ICOs, would have resulted in an average return of 1,320 percent. Most large-scale ICOs (those over US$10 million) are dominated by the blockchain economy or the financial services industry.

Australasia

South Korea to Fight ICO Ban

The task force that has been deployed to prepare for South Korea’s ICO ban will have their hands full. The industry is not planning on backing down so soon. Individuals like Kim Tae-won, CTO of blockchain startup Glosfer, are rallying up the troops for an official petition. The law firm he hired has found that ICOs cannot be penalized under existing laws. Forbes tells more.