The name J.R. Willett likely doesn’t ring a bell.

Unless you’re a cryptocurrency stalwart, chances are the impact of this personality on cryptocurrency and blockchain is lost on you. In actual fact, Willett has been instrumental in giving us one of the most unique features of this new technology: initial coin offerings, or ICOs.

The Dawn of the ICO

It’s difficult mentioning “cryptocurrency” without the word “ICO” sneaking into the conversation. It gives public servants sleepless nights, makes techpreneurs draw up business plans, and gives average Janes and Joes a chance to become investors in the hottest new tech on the market.

Many people who are new to the crypto game assume that initial coin offerings were part of the original Bitcoin proposal set forth by Satoshi Nakamoto in 2008. In reality, the ICO came about 4 years later and was masterminded by Willett as part of his MasterCoin (now Omni) protocol proposal.

J.R. Willett: The Man Who Invented the ICO

Willett studied Computer Science at Seattle Pacific University. After quick stints in an online campus blind date service and an underground student newspaper, he settled in his first job as a software engineer at Dynon Avionics.

Over time, and with his programming expertise, the company grew from a “shared dream and a couple rented cubicles” to an industry leader. This would not be the last time this happens.

Years later, as lead developer at planning software company Cozi, Willett started developing the Mastercoin protocol on top of Bitcoin. In January 2012, he published a white paper titled “The Second Bitcoin White Paper”, detailing MasterCoin’s proposal for blockchain protocols to fund itself.

Thus, the ICO was born, and the rest, truly, is history.

The Second Bitcoin White Paper

With the publication of Willett’s white paper came the inception for what is today known as an ingenious way to fund a blockchain venture. Love it or hate it, ICOs have leveled the playing field as far as startup capital is concerned, making it a tool for any team to bring their idea to life.

Willett originally stated:

A protocol can pay for its own software development, ‘bootstrapping’ itself into existence, utilizing a trusted entity to hold funds and hire developers.

It is possible to create tools to allow end-users to create currency protocol layers which have a stable value, pegged to an external currency or commodity. In this way, users of these currencies can own stabilized virtual currency tied to U.S. Dollars, Euros, ounces of gold, barrels of oil, etc.

It is possible for users of these new currencies to exchange between currencies with each other using simple rules and no central exchange.

Getting the Word Out

Creator, founder, pioneer, designer. These are terms that conjure up visions of Hollywood-worthy Eureka! scenes, but the reality is often far less glamorous. Instead, it’s usually many Lone Ranger fits and starts to get others to buy into the idea, and the concept of the ICO was no different.

A year after Willett first started presenting his ideas to the Bitcoin community, he was finally taken up on his offer to “find somebody who wants [his] coins.” At the 2013 San Jose Bitcoin conference, someone finally ‘took his bitcoins’, setting the scene for what would become fintech’s hottest new trend in 2017.

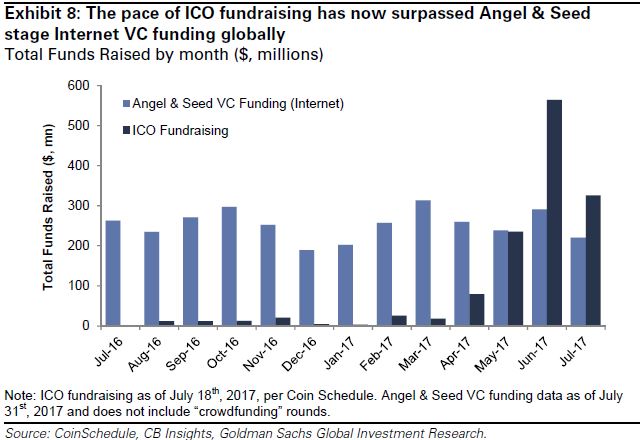

The ICO ended up being built on the Ethereum ERC20 token and not Bitcoin, as Willett first envisioned, but there’s no denying that he set in motion one of the biggest game changers the world has seen in a long time. ICOs now surpass early stage venture capital (VC) funding.

OMNI

MasterCoin (since relaunched as OMNI) sparked what is today standard cryptocurrency practice. According to Willett, the protocol is HTML to Ethereum’s JavaScript.

The world’s first ICO raised US$500,000, later appreciating to US$5 million.

Willett continues to serve as chief architect at the OMNI foundation. The ecosystem has been used to run blockchain projects such as MaidSafe (which has proffered valuable ICO management lessons in the process).

UpToken

Willett’s latest project is UpToken, which he calls “The Perfect Token Sale”. Developed in unison with crypto ATM company Coinme, UpToken is an ‘ATM token’ that rewards users for using cryptocurrency ATMs.

Since its success will be wholly reliant on whether crypto can evolve its current buy-and-hold status into a utility currency, time will tell if Willett’s latest vision is as on the mark as his ICO design.

The Success of ICOs

Willett’s pioneering legacy has shifted the market radically. ICOs are disrupting the way technology is funded, for better or worse.

State organizations are wary and are keeping an eye on ICOs. Governments around the world are racing to get to terms with, or on top of, initial coin offerings. Countries like China and South Korea have banned ICOs completely, while others the likes of Japan, the USA, and Canada have ruled that they function as securities and are thus subject to the country’s fiscal regulations.

Yet for private investors, they present a major opportunity. A study by venture capital firm Mangrove Capital Partners has found that investing in ICOs nets an average return of 1,320 percent.

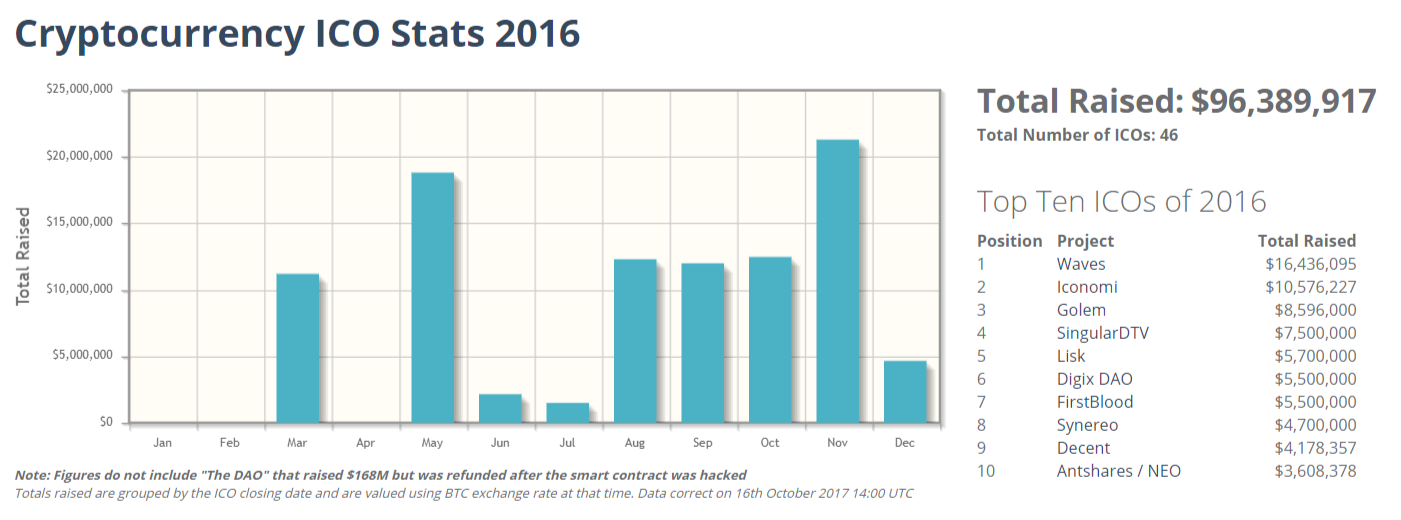

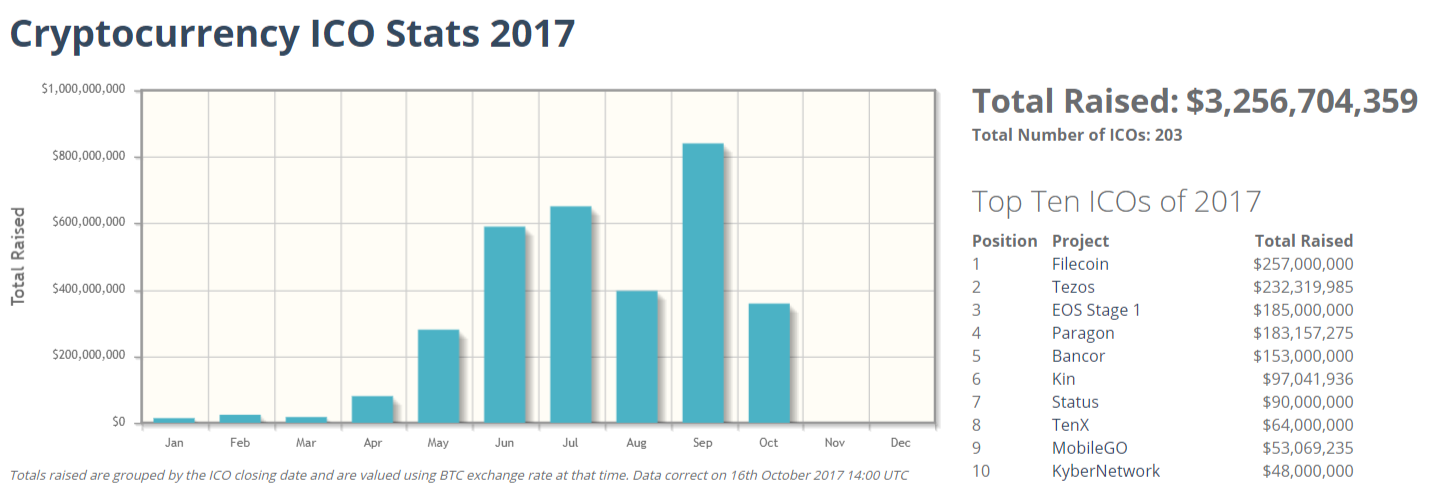

Overall, the numbers are unanimous: ICOs are making themselves known in large dollar sums.

Data courtesy of CoinSchedule

The Future of ICOs

It’s anyone’s guess what tomorrow holds in the ICO scene. On a country-by-country basis, there are highs and lows, but at the moment it’s what is building the cryptocurrency market as well as the growth and development of blockchain technology.

One could easily argue that the boom we’re experiencing is largely due to the ease-of-access to startup capital brought about by ICO funds. US$3.35 billion has been raised to date — numbers in which the general public has a vested, and invested, interest. It reflects a truly distributed financial model for a distributed technology.