Japan has been making headlines recently, albeit it in a very different direction than that of its Chinese neighbour. While China is putting down the iron fist, Japan seems to be welcoming the industry with open – if well-deliberated – arms. Although the country has seen a recent government involvement, there are no signs of bringing cryptocurrency trade to a halt.

ICOs under scrutiny

After Japan’s new laws establishing cryptocurrencies as a viable payment alternative came into effect in April, cryptocurrency exchanges were given a September deadline to register with the government-run Financial Services Agency (FSA), for an October starting date for going into full FSA surveillance mode.

Cryptocurrency exchange licensing

The FSA then issued operating licenses to 11 government-sanctioned cryptocurrency exchanges. Tokyo is eager to avoid a repeat of the city-based Mt. Gox disaster, once the world’s largest Bitcoin exchange that in 2014 disappeared with 7% of all Bitcoins in existence at the time. (Thanks to Bitcoin’s rising price, Mt. Gox may ‘unfailure’ itself yet.)

Rising trading volumes

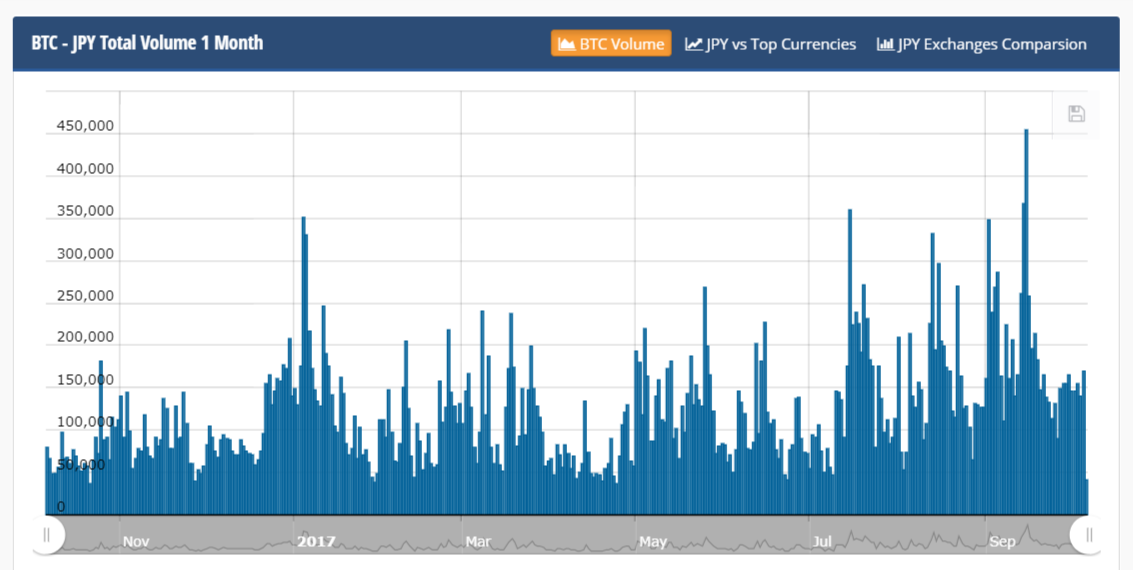

While September saw China and South Korea both ban ICOs, and various news stories and developments caused Bitcoin’s all-time high price to drop, in Japan, it was the country’s highest trading-spend month to date. So much so that it’s made Japan the largest Bitcoin market in the world at the moment. Which is good news in a country where the government considers it a currency just like any other. More than 4,200 shops accept Bitcoin as payment.

While there are many factors influencing the rise of Japan’s trading volumes, it’s clear that the country is adopting cryptocurrency at unprecedented speed. Another win for a country whose economy has steadily risen from the ashes of the Second World War to the world’s third-largest nominal GDP.

What tomorrow brings

Time will be telling if Japan’s low ICO-activity will start seeing a rise to coincide with China’s alt-coin ‘murder spree’. For now, the world is on watch, eager to learn from the rise of the new cryptocurrency front-runner.