Sending cryptocurrencies around the world wide web can be confusing, costly and time consuming if you don’t know what you’re doing. Once you’ve learned how to do this, you probably still don’t do it as time-and cost effective as possible. Before you continue reading, make sure you understand crypto trade and transaction fees.

Do you currently:

- Use a wallet when sending cryptocurrencies from exchange to exchange?

- Simply accept the transaction fees of your wallet?

- Mostly use Bitcoin for transactions and trades?

This article will help you to develop a more efficient strategy for sending and trading cryptocurrencies.

Buying Shiny New Cryptocurrencies

For every new crypto investment, you’ll need to convert your hard-earned fiat into crypto. You can do this on exchanges that accept fiat currencies like Dollars, Euros, Yuans and Wons.

There aren’t too many of those as accepting fiat comes with some legal issues. Kraken, Coinbase (expensive), Bitfinex (questionable policies), Gemini and Bitstamp are some exchanges that accept fiat. Do note that some exchanges charge higher fees for fiat-to-crypto transactions.

If you want to buy cryptocurrencies that can be bought with fiat such as Bitcoin, Ethereum, Ripple and Litecoin, then you simply have to buy and store them. Remember, cyber safety first!

However, it gets a bit more complicated if you want to trade your newly-acquired crypto for other cryptocurrencies. You can only buy a very limited number of cryptocurrencies that can be directly traded for fiat. Moreover, every exchange has a limited number of cryptocurrencies for sale. Both of these limitations will force you to put in some additional effort.

For instance, you’ve read great things about the Steem blockchain and you want to buy some Steem cryptos. You send your fiat to a fiat-accepting exchange, but none of them offer the option to buy Steem.

You will first have to buy a fiat-paired cryptocurrency like Dash, Bitcoin or Ethereum (incurring a trade fee), send it from that exchange to an exchange that does have a Steem market (incurring a network fee), and buy Steem (incurring another trade fee).

Exchange-to-Exchange Transactions

Yes, you can send cryptos from your wallet on one exchange to a wallet on another exchange. This will save you time and one transaction fee.

Here are two important rules to follow when making exchange-to-exchange transactions:

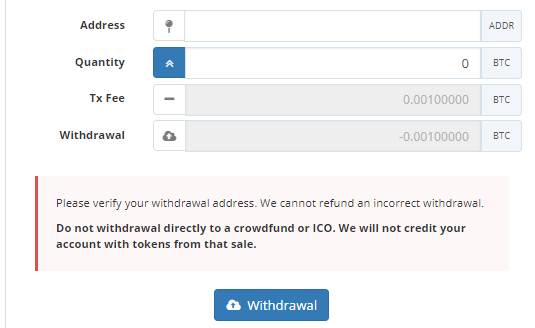

Rule #1: Copy and paste your public key. Copying your public key manually drastically increases the chances of a typo which will cause your cryptos will vanish. Apply this rule for any crypto transaction.

Rule #2: Always make sure you have opened the correct wallet on the receiving exchange. For example, for Bitcoin, double check that you’ve actually opened your Bitcoin wallet and not your BitcoinCash wallet. Sending your cryptos to a wrong wallet will make you lose them in cyberspace.

Do keep in mind that there is no wallet for each crypto on each exchange. This means you’ll have to do extra trades, which cost trade fees. Say you have Ark on Bittrex and you want to buy Walton on Binance. Binance doesn’t accept Ark, so you’ll have to sell Ark for Bitcoin or Litecoin, send it to Binance and then buy Walton.

Using Your Wallet

Exchanges are not the safest way of storing your cryptocurrencies, as you are not in control of your private keys. Therefore, it’s wise to store your cryptos in a personal wallet if you’re riding the crypto waves, buying low and selling high.

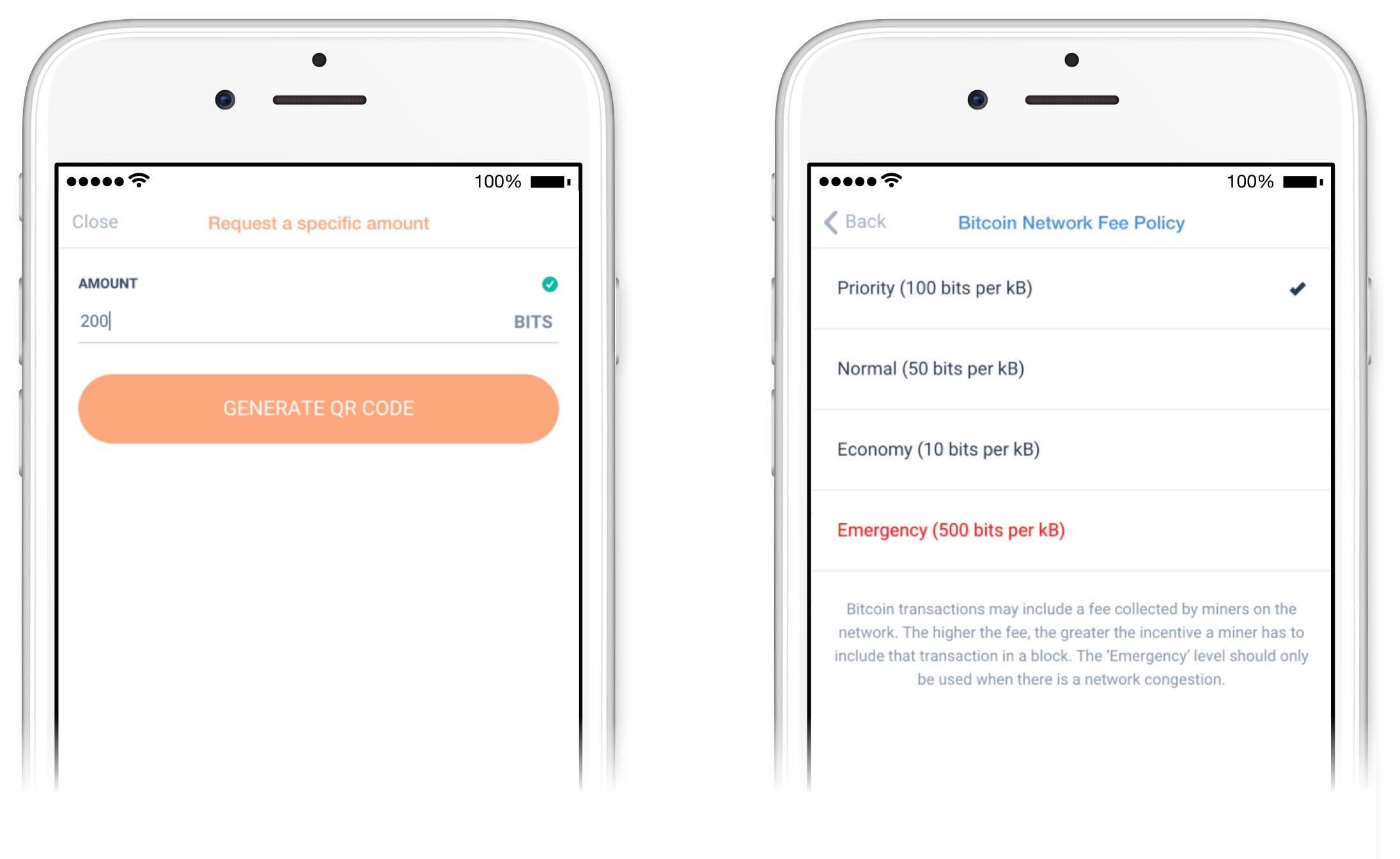

Before sending cryptos from your wallet, go to the settings of your wallet and check the transaction fees. Most wallets allow you to change these fees. Check on the accepted transaction fees before setting them, because a transaction fee that’s too low may lead to your transaction taking a very long time or even never happening.

If you’re day trading, you want to be liquid and using wallets for cryptocurrency transactions will become expensive. This is because too many transactions will lead to a substantial transaction bill, especially for Bitcoin. Make sure you first research which cryptos are available on which exchanges and plan your transactions so you don’t have to incur additional trading fees.

Pros and Cons of Using Bitcoin for Transactions

Bitcoin is paired with all cryptocurrencies and all exchanges have a Bitcoin wallet for you. Because of this, Bitcoin seems like the best crypto to have for buying and selling altcoins and sending money around. It definitely is the easiest way, but definitely not the cheapest or the fastest cryptocurrency around.

You pay your Bitcoin transaction fees in Satoshi per byte. Because the number of Bitcoin users has drastically increased and Bitcoin’s block size is limited, the prices have risen enormously over the last months.

Miners will first process transactions with the highest transaction fees, which has caused smaller transactions to be disproportionately expensive. If you don’t want to pay high transaction fees, it can take a very long time for your transaction to come through.

If you only make a few large transactions, using Bitcoin isn’t the worst idea as the sum of your total transaction fees will be relatively small. However, when you are conducting a lot of transactions, your total fees paid can become shockingly high.

Unless you are making a lot of trades or you send and receive a lot of cryptocurrencies for your business or personal use, a lot of the value of these transactions can vanish. For example, your friend spotted you a beer and you thought it’d be cool to send him some Bitcoin. To make this microtransaction come through, your fee can be about the same price as the beer.

There are ways to deal with the transaction fees of Bitcoin or you can start using other, cheaper and faster cryptocurrencies.

Using Other Cryptocurrencies For Transactions

Even though Ethereum is experiencing similar scalability problems as Bitcoin, it still is a whole lot cheaper and faster. Ethereum is accepted by every serious exchange, paired with almost every fiat currency and there are numerous wallets out there for Ethereum. Moreover, Ethereum is paired with every single token built on the Ethereum blockchain, the ERC20, and even paired with a lot of other cryptocurrencies.

Ripple’s XRP is one of the fastest and cheapest cryptocurrencies, and it is paired with most fiat currencies and accepted by most exchanges. Sending it from Kraken to another exchange takes about 8 seconds and you won’t even notice the cost. After that, you can sell your Ripple for Bitcoin and buy your desired crypto, which does come with an additional trade fee. This sums up the major disadvantage of Ripple, as it is only paired with one crypto, Bitcoin. It’s great for sending value to other people though.

When I see a buy opportunity and I want to buy a crypto with some Euros I have, I convert my Euros to Litecoin. Litecoin is a lot faster and cheaper than its big brother, Bitcoin. Because it’s a fork of the Bitcoin Core client, Litecoin can easily be paired with fiat and cryptocurrencies alike. It is accepted by most exchanges, and it is cheaper and faster than Ethereum. Although Ripple is cheaper and faster than Litecoin, Litecoin’s advantage is its large number of pairing options.

I have to mention IOTA since it has zero transaction fees. Currently, IOTA can only be bought on 5 exchanges, of which only Bitfinex and Binance are serious players. It is only paired with the Dollar, Bitcoin and Ethereum. This will change over time and once IOTA is more widely accepted, its zero-fee policy is very attractive for sending crypto.

For a comprehensive overview of the transaction fees of the larger cryptocurrencies, click here. Ripple is excluded from this tool, as a substantial part of the community don’t regard it as a real blockchain.

In Conclusion

“What are you sending the cryptos for and how often?” is a key question to ask yourself.

The higher the frequency of transactions, the more important it becomes to decrease transaction fees. In order to create a cost-efficient strategy for trading, consider the following:

- How many transactions do I make?

- Which exchanges accept the cryptocurrency I want to buy/sell?

- Is there a better alternative to Bitcoin for this action?

- Does my wallet allow for transaction fee adjustments?

If you run a business on cryptocurrencies, receive donations in them or use cryptocurrencies for transactions with acquaintances, Ripple will save you time and money.

Until Bitcoin resolves its scalability issues, consider using Ethereum and Litecoin as they are more practical when making a lot of transactions involving trades. Litecoin is particularly attractive as it’s cheaper and faster than Ethereum.